diff --git a/.eslintrc.js b/.eslintrc.js

index 75a74ed371c4..35a4a333f8af 100644

--- a/.eslintrc.js

+++ b/.eslintrc.js

@@ -37,10 +37,12 @@ module.exports = {

overrides: [

{

files: ['*.js', '*.jsx', '*.ts', '*.tsx'],

+ plugins: ['react'],

rules: {

'rulesdir/no-multiple-onyx-in-file': 'off',

'rulesdir/onyx-props-must-have-default': 'off',

'react-native-a11y/has-accessibility-hint': ['off'],

+ 'react/jsx-no-constructed-context-values': 'error',

'react-native-a11y/has-valid-accessibility-descriptors': [

'error',

{

@@ -116,7 +118,7 @@ module.exports = {

},

{

selector: ['parameter', 'method'],

- format: ['camelCase'],

+ format: ['camelCase', 'PascalCase'],

},

],

'@typescript-eslint/ban-types': [

diff --git a/.well-known/apple-app-site-association b/.well-known/apple-app-site-association

index 1e63fdcb2d52..b3adf0f59b9c 100644

--- a/.well-known/apple-app-site-association

+++ b/.well-known/apple-app-site-association

@@ -80,6 +80,10 @@

"/": "/search/*",

"comment": "Search"

},

+ {

+ "/": "/send/*",

+ "comment": "Send money"

+ },

{

"/": "/money2020/*",

"comment": "Money 2020"

diff --git a/android/app/build.gradle b/android/app/build.gradle

index 1b8eac0c5c20..fa2bd3865ca2 100644

--- a/android/app/build.gradle

+++ b/android/app/build.gradle

@@ -90,8 +90,8 @@ android {

minSdkVersion rootProject.ext.minSdkVersion

targetSdkVersion rootProject.ext.targetSdkVersion

multiDexEnabled rootProject.ext.multiDexEnabled

- versionCode 1001038500

- versionName "1.3.85-0"

+ versionCode 1001038708

+ versionName "1.3.87-8"

}

flavorDimensions "default"

diff --git a/android/app/src/main/AndroidManifest.xml b/android/app/src/main/AndroidManifest.xml

index 7419d5b1e1a7..74e91caa91d5 100644

--- a/android/app/src/main/AndroidManifest.xml

+++ b/android/app/src/main/AndroidManifest.xml

@@ -70,6 +70,7 @@

+

@@ -88,6 +89,7 @@

+

diff --git a/assets/images/bankicons/american-express.svg b/assets/images/bankicons/american-express.svg

index b22ccbb4169a..0ab8383d46ed 100644

--- a/assets/images/bankicons/american-express.svg

+++ b/assets/images/bankicons/american-express.svg

@@ -1,38 +1,23 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/bank-of-america.svg b/assets/images/bankicons/bank-of-america.svg

index 0d962a914cfd..e4f87be611fc 100644

--- a/assets/images/bankicons/bank-of-america.svg

+++ b/assets/images/bankicons/bank-of-america.svg

@@ -1,22 +1,22 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/bb-t.svg b/assets/images/bankicons/bb-t.svg

index 13dba55f68f4..7e7bf1f29ee4 100644

--- a/assets/images/bankicons/bb-t.svg

+++ b/assets/images/bankicons/bb-t.svg

@@ -1,27 +1,25 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/capital-one.svg b/assets/images/bankicons/capital-one.svg

index 116543884e52..c37c8e3ca582 100644

--- a/assets/images/bankicons/capital-one.svg

+++ b/assets/images/bankicons/capital-one.svg

@@ -1,55 +1,53 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/charles-schwab.svg b/assets/images/bankicons/charles-schwab.svg

index 4ba4ca4f9488..181a668965da 100644

--- a/assets/images/bankicons/charles-schwab.svg

+++ b/assets/images/bankicons/charles-schwab.svg

@@ -1,59 +1,58 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/chase.svg b/assets/images/bankicons/chase.svg

index 1df546e9785b..70f0b911f147 100644

--- a/assets/images/bankicons/chase.svg

+++ b/assets/images/bankicons/chase.svg

@@ -1,12 +1,13 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/citibank.svg b/assets/images/bankicons/citibank.svg

index 482f33c8b9c9..b03e1efe9bb6 100644

--- a/assets/images/bankicons/citibank.svg

+++ b/assets/images/bankicons/citibank.svg

@@ -1,18 +1,18 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/citizens-bank.svg b/assets/images/bankicons/citizens-bank.svg

index 19160a747490..a0cdc6c1df2b 100644

--- a/assets/images/bankicons/citizens-bank.svg

+++ b/assets/images/bankicons/citizens-bank.svg

@@ -1,49 +1,47 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/discover.svg b/assets/images/bankicons/discover.svg

index 60396e16d29e..75db16e4d1c1 100644

--- a/assets/images/bankicons/discover.svg

+++ b/assets/images/bankicons/discover.svg

@@ -1 +1,47 @@

-

\ No newline at end of file

+

+

+

diff --git a/assets/images/bankicons/expensify-background.png b/assets/images/bankicons/expensify-background.png

new file mode 100644

index 000000000000..ab7b71d34e11

Binary files /dev/null and b/assets/images/bankicons/expensify-background.png differ

diff --git a/assets/images/bankicons/expensify.svg b/assets/images/bankicons/expensify.svg

new file mode 100644

index 000000000000..b61773e8d838

--- /dev/null

+++ b/assets/images/bankicons/expensify.svg

@@ -0,0 +1,18 @@

+

+

+

diff --git a/assets/images/bankicons/fidelity.svg b/assets/images/bankicons/fidelity.svg

index ac0a05babc95..d49eca17c12d 100644

--- a/assets/images/bankicons/fidelity.svg

+++ b/assets/images/bankicons/fidelity.svg

@@ -1,17 +1,17 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/generic-bank-account.svg b/assets/images/bankicons/generic-bank-account.svg

index 8912413c668d..493f06b335d8 100644

--- a/assets/images/bankicons/generic-bank-account.svg

+++ b/assets/images/bankicons/generic-bank-account.svg

@@ -1,14 +1,14 @@

-

+

diff --git a/assets/images/bankicons/huntington-bank.svg b/assets/images/bankicons/huntington-bank.svg

index e6b43b78daaa..40909a273e19 100644

--- a/assets/images/bankicons/huntington-bank.svg

+++ b/assets/images/bankicons/huntington-bank.svg

@@ -1,24 +1,22 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/navy-federal-credit-union.svg b/assets/images/bankicons/navy-federal-credit-union.svg

index 5541daa9f49a..898cd03768f0 100644

--- a/assets/images/bankicons/navy-federal-credit-union.svg

+++ b/assets/images/bankicons/navy-federal-credit-union.svg

@@ -1,89 +1,85 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/pnc.svg b/assets/images/bankicons/pnc.svg

index 104abb28ba05..3f78dbe94f47 100644

--- a/assets/images/bankicons/pnc.svg

+++ b/assets/images/bankicons/pnc.svg

@@ -1,19 +1,17 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/regions-bank.svg b/assets/images/bankicons/regions-bank.svg

index 2de53c116064..bff045f0eb5a 100644

--- a/assets/images/bankicons/regions-bank.svg

+++ b/assets/images/bankicons/regions-bank.svg

@@ -1,40 +1,38 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/suntrust.svg b/assets/images/bankicons/suntrust.svg

index 256b8157600f..b5b94c105b14 100644

--- a/assets/images/bankicons/suntrust.svg

+++ b/assets/images/bankicons/suntrust.svg

@@ -1,220 +1,217 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/td-bank.svg b/assets/images/bankicons/td-bank.svg

index 03f100171f67..84675de5f2bf 100644

--- a/assets/images/bankicons/td-bank.svg

+++ b/assets/images/bankicons/td-bank.svg

@@ -1,16 +1,14 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/us-bank.svg b/assets/images/bankicons/us-bank.svg

index d1364e253e62..e091ba0a6f50 100644

--- a/assets/images/bankicons/us-bank.svg

+++ b/assets/images/bankicons/us-bank.svg

@@ -1,29 +1,27 @@

-

-

-

+

+

+

diff --git a/assets/images/bankicons/usaa.svg b/assets/images/bankicons/usaa.svg

index 2552db28eca3..1e137fab626f 100644

--- a/assets/images/bankicons/usaa.svg

+++ b/assets/images/bankicons/usaa.svg

@@ -1,38 +1,36 @@

-

-

-

+

+

+

diff --git a/assets/images/cardicons/american-express.svg b/assets/images/cardicons/american-express.svg

new file mode 100644

index 000000000000..9e31f7c8a08e

--- /dev/null

+++ b/assets/images/cardicons/american-express.svg

@@ -0,0 +1,25 @@

+

+

+

diff --git a/assets/images/cardicons/bank-of-america.svg b/assets/images/cardicons/bank-of-america.svg

new file mode 100644

index 000000000000..62dd510b0649

--- /dev/null

+++ b/assets/images/cardicons/bank-of-america.svg

@@ -0,0 +1,25 @@

+

+

+

diff --git a/assets/images/cardicons/bb-t.svg b/assets/images/cardicons/bb-t.svg

new file mode 100644

index 000000000000..ad3676458d21

--- /dev/null

+++ b/assets/images/cardicons/bb-t.svg

@@ -0,0 +1,33 @@

+

+

+

diff --git a/assets/images/cardicons/capital-one.svg b/assets/images/cardicons/capital-one.svg

new file mode 100644

index 000000000000..ee4f756e2600

--- /dev/null

+++ b/assets/images/cardicons/capital-one.svg

@@ -0,0 +1,67 @@

+

+

+

diff --git a/assets/images/cardicons/charles-schwab.svg b/assets/images/cardicons/charles-schwab.svg

new file mode 100644

index 000000000000..39c894042cd3

--- /dev/null

+++ b/assets/images/cardicons/charles-schwab.svg

@@ -0,0 +1,76 @@

+

+

+

diff --git a/assets/images/cardicons/chase.svg b/assets/images/cardicons/chase.svg

new file mode 100644

index 000000000000..8e8ddb6d5378

--- /dev/null

+++ b/assets/images/cardicons/chase.svg

@@ -0,0 +1,15 @@

+

+

+

diff --git a/assets/images/cardicons/citibank.svg b/assets/images/cardicons/citibank.svg

new file mode 100644

index 000000000000..f9869aee7146

--- /dev/null

+++ b/assets/images/cardicons/citibank.svg

@@ -0,0 +1,22 @@

+

+

+

diff --git a/assets/images/cardicons/citizens.svg b/assets/images/cardicons/citizens.svg

new file mode 100644

index 000000000000..3b4bf9ea1af3

--- /dev/null

+++ b/assets/images/cardicons/citizens.svg

@@ -0,0 +1,57 @@

+

+

+

diff --git a/assets/images/cardicons/discover.svg b/assets/images/cardicons/discover.svg

new file mode 100644

index 000000000000..668e5634339d

--- /dev/null

+++ b/assets/images/cardicons/discover.svg

@@ -0,0 +1,53 @@

+

+

+

diff --git a/assets/images/cardicons/expensify-card-dark.svg b/assets/images/cardicons/expensify-card-dark.svg

new file mode 100644

index 000000000000..4a65afeeda9d

--- /dev/null

+++ b/assets/images/cardicons/expensify-card-dark.svg

@@ -0,0 +1,78 @@

+

+

+

diff --git a/assets/images/cardicons/fidelity.svg b/assets/images/cardicons/fidelity.svg

new file mode 100644

index 000000000000..c87f9c4aa56c

--- /dev/null

+++ b/assets/images/cardicons/fidelity.svg

@@ -0,0 +1,21 @@

+

+

+

diff --git a/assets/images/cardicons/generic-bank-card.svg b/assets/images/cardicons/generic-bank-card.svg

new file mode 100644

index 000000000000..f700691ac29b

--- /dev/null

+++ b/assets/images/cardicons/generic-bank-card.svg

@@ -0,0 +1,14 @@

+

+

+

diff --git a/assets/images/cardicons/huntington-bank.svg b/assets/images/cardicons/huntington-bank.svg

new file mode 100644

index 000000000000..c108c7039898

--- /dev/null

+++ b/assets/images/cardicons/huntington-bank.svg

@@ -0,0 +1,26 @@

+

+

+

diff --git a/assets/images/cardicons/navy-federal-credit-union.svg b/assets/images/cardicons/navy-federal-credit-union.svg

new file mode 100644

index 000000000000..5abc1103cce1

--- /dev/null

+++ b/assets/images/cardicons/navy-federal-credit-union.svg

@@ -0,0 +1,105 @@

+

+

+

diff --git a/assets/images/cardicons/pnc.svg b/assets/images/cardicons/pnc.svg

new file mode 100644

index 000000000000..ae4d4aac8e41

--- /dev/null

+++ b/assets/images/cardicons/pnc.svg

@@ -0,0 +1,18 @@

+

+

+

diff --git a/assets/images/cardicons/regions-bank.svg b/assets/images/cardicons/regions-bank.svg

new file mode 100644

index 000000000000..1837ad2be41b

--- /dev/null

+++ b/assets/images/cardicons/regions-bank.svg

@@ -0,0 +1,45 @@

+

+

+

diff --git a/assets/images/cardicons/suntrust.svg b/assets/images/cardicons/suntrust.svg

new file mode 100644

index 000000000000..32ea5096f876

--- /dev/null

+++ b/assets/images/cardicons/suntrust.svg

@@ -0,0 +1,237 @@

+

+

+

diff --git a/assets/images/cardicons/td-bank.svg b/assets/images/cardicons/td-bank.svg

new file mode 100644

index 000000000000..19988e35bbbe

--- /dev/null

+++ b/assets/images/cardicons/td-bank.svg

@@ -0,0 +1,17 @@

+

+

+

diff --git a/assets/images/cardicons/us-bank.svg b/assets/images/cardicons/us-bank.svg

new file mode 100644

index 000000000000..321b4cb755b0

--- /dev/null

+++ b/assets/images/cardicons/us-bank.svg

@@ -0,0 +1,32 @@

+

+

+

diff --git a/assets/images/cardicons/usaa.svg b/assets/images/cardicons/usaa.svg

new file mode 100644

index 000000000000..bb634f64e658

--- /dev/null

+++ b/assets/images/cardicons/usaa.svg

@@ -0,0 +1,40 @@

+

+

+

diff --git a/docs/Gemfile.lock b/docs/Gemfile.lock

index 27656eeb68f0..de99bbcb48ef 100644

--- a/docs/Gemfile.lock

+++ b/docs/Gemfile.lock

@@ -256,6 +256,7 @@ GEM

PLATFORMS

arm64-darwin-22

+ arm64-darwin-23

x86_64-darwin-20

x86_64-darwin-21

diff --git a/docs/_data/_routes.yml b/docs/_data/_routes.yml

index c6733ac11715..84735e95e0e9 100644

--- a/docs/_data/_routes.yml

+++ b/docs/_data/_routes.yml

@@ -44,16 +44,21 @@ platforms:

icon: /assets/images/hand-card.svg

description: Explore how the Expensify Card combines convenience and security to enhance everyday business transactions. Discover how to apply for, oversee, and maximize your card perks here.

- - href: exports

- title: Exports

- icon: /assets/images/monitor.svg

- description: From exporting reports to creating custom templates, here is where you can learn more about Expensify's versatile export options.

+ - href: expensify-partner-program

+ title: Expensify Partner Program

+ icon: /assets/images/handshake.svg

+ description: Discover how to get the most out of Expensify as an ExpensifyApproved! accountant partner. Learn how to set up your clients, receive CPE credits, and take advantage of your partner discount.

- href: get-paid-back

title: Get Paid Back

icon: /assets/images/money-into-wallet.svg

description: Whether you submit an expense report or an invoice, find out here how to ensure a smooth and timely payback process every time.

+ - href: insights-and-custom-reporting

+ title: Insights & Custom Reporting

+ icon: /assets/images/monitor.svg

+ description: From exporting reports to creating custom templates, here is where you can learn more about Expensify's versatile export options.

+

- href: integrations

title: Integrations

icon: /assets/images/workflow.svg

@@ -64,15 +69,15 @@ platforms:

icon: /assets/images/envelope-receipt.svg

description: Master the art of overseeing employees and reports by utilizing Expensify’s automation features and approval workflows.

- - href: policy-and-domain-settings

- title: Policy & Domain Settings

- icon: /assets/images/shield.svg

- description: Discover how to set up and manage policies, define user permissions, and implement compliance rules to maintain a secure and compliant financial management landscape.

-

- href: send-payments

title: Send Payments

icon: /assets/images/money-wings.svg

description: Uncover step-by-step guidance on sending direct reimbursements to employees, paying an invoice to a vendor, and utilizing third-party payment options.

+

+ - href: workspace-and-domain-settings

+ title: Workspace & Domain Settings

+ icon: /assets/images/shield.svg

+ description: Discover how to set up and manage workspace, define user permissions, and implement compliance rules to maintain a secure and compliant financial management landscape.

- href: new-expensify

title: New Expensify

@@ -113,16 +118,21 @@ platforms:

icon: /assets/images/hand-card.svg

description: Explore how the Expensify Card combines convenience and security to enhance everyday business transactions. Discover how to apply for, oversee, and maximize your card perks here.

- - href: exports

- title: Exports

- icon: /assets/images/monitor.svg

- description: From exporting reports to creating custom templates, here is where you can learn more about Expensify's versatile export options.

+ - href: expensify-partner-program

+ title: Expensify Partner Program

+ icon: /assets/images/handshake.svg

+ description: Discover how to get the most out of Expensify as an ExpensifyApproved! accountant partner. Learn how to set up your clients, receive CPE credits, and take advantage of your partner discount.

- href: get-paid-back

title: Get Paid Back

icon: /assets/images/money-into-wallet.svg

description: Whether you submit an expense report or an invoice, find out here how to ensure a smooth and timely payback process every time.

+ - href: insights-and-custom-reporting

+ title: Insights & Custom Reporting

+ icon: /assets/images/monitor.svg

+ description: From exporting reports to creating custom templates, here is where you can learn more about Expensify's versatile export options.

+

- href: integrations

title: Integrations

icon: /assets/images/workflow.svg

diff --git a/docs/_sass/_main.scss b/docs/_sass/_main.scss

index 3ad2276713da..c887849ffd99 100644

--- a/docs/_sass/_main.scss

+++ b/docs/_sass/_main.scss

@@ -371,9 +371,26 @@ button {

flex-wrap: wrap;

}

+ h1 {

+ font-size: 1.5em;

+ padding: 20px 0 12px 0;

+ }

+

+ h2 {

+ font-size: 1.125em;

+ font-weight: 500;

+ font-family: "ExpensifyNewKansas", "Helvetica Neue", "Helvetica", Arial, sans-serif;

+ }

+

+ h3 {

+ font-size: 1em;

+ font-family: "ExpensifyNeue", "Helvetica Neue", "Helvetica", Arial, sans-serif;

+ }

+

h2,

h3 {

- font-family: "ExpensifyNewKansas", "Helvetica Neue", "Helvetica", Arial, sans-serif;

+ margin: 0;

+ padding: 12px 0 12px 0;

}

blockquote {

diff --git a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Business-Bank-Account-(AUD).md b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Business-Bank-Account-(AUD).md

deleted file mode 100644

index 1fa5734293ac..000000000000

--- a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Business-Bank-Account-(AUD).md

+++ /dev/null

@@ -1,51 +0,0 @@

----

-title: Add-a-Business-Bank-Account-(AUD).md

-description: This article provides insight on setting up and using an Australian Business Bank account in Expensify.

----

-

-# How to add an Australian business bank account (for admins)

-A withdrawal account is the business bank account that you want to use to pay your employee reimbursements.

-

-_Your policy currency must be set to AUD and reimbursement setting set to Indirect to continue. If your main policy is used for something other than AUD, then you will need to create a new one and set that policy to AUD._

-

-To set this up, you’ll run through the following steps:

-

-1. Go to **Settings > Your Account > Payments** and click **Add Verified Bank Account**

-{:width="100%"}

-

-2. Enter the required information to connect to your business bank account. If you don't know your Bank User ID/Direct Entry ID/APCA Number, please contact your bank and they will be able to provide this.

-{:width="100%"}

-

-3. Link the withdrawal account to your policy by heading to **Settings > Policies > Group > [Policy name] > Reimbursement**

-4. Click **Direct reimbursement**

-5. Set the default withdrawal account for processing reimbursements

-6. Tell your employees to add their deposit accounts and start reimbursing.

-

-# How to delete a bank account

-If you’re no longer using a bank account you previously connected to Expensify, you can delete it by doing the following:

-

-1. Navigate to Settings > Accounts > Payments

-2. Click **Delete**

-{:width="100%"}

-

-You can complete this process either via the web app (on a computer), or via the mobile app.

-

-# Deep Dive

-## Bank-specific batch payment support

-

-If you are new to using Batch Payments in Australia, to reimburse your staff or process payroll, you may want to check out these bank-specific instructions for how to upload your .aba file:

-

-- ANZ Bank - [Import a file for payroll payments](https://www.anz.com.au/support/internet-banking/pay-transfer-business/payroll/import-file/)

-- CommBank - [Importing and using

Direct Entry (EFT) files](https://www.commbank.com.au/business/pds/003-279-importing-a-de-file.pdf)

-- Westpac - [Importing Payment Files](https://www.westpac.com.au/business-banking/online-banking/support-faqs/import-files/)

-- NAB - [Quick Reference Guide - Upload a payment file](https://www.nab.com.au/business/online-banking/nab-connect/help)

-- Bendigo Bank - [Bulk payments user guide](https://www.bendigobank.com.au/globalassets/documents/business/bulk-payments-user-guide.pdf)

-- Bank of Queensland - [Payments file upload facility FAQ](https://www.boq.com.au/help-and-support/online-banking/ob-faqs-and-support/faq-pfuf)

-

-**Note:** Some financial institutions require an ABA file to include a *self-balancing transaction*. If you are unsure, please check with your bank to ensure whether to tick this option or not, as selecting an incorrect option will result in the ABA file not working with your bank's internet banking platform.

-

-## Enable Global Reimbursement

-

-If you have employees in other countries outside of Australia, you can now reimburse them directly using Global Reimbursement.

-

-To do this, you’ll first need to delete any existing Australian business bank accounts. Then, you’ll want to follow the instructions to enable Global Reimbursements

diff --git a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Business-Bank-Accounts-AUD.md b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Business-Bank-Accounts-AUD.md

index 7c789942a2b3..b59f68a65ce6 100644

--- a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Business-Bank-Accounts-AUD.md

+++ b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Business-Bank-Accounts-AUD.md

@@ -1,5 +1,51 @@

---

-title: Business Bank Accounts - AUD

-description: Business Bank Accounts - AUD

+title: Add a Business Bank Account

+description: This article provides insight on setting up and using an Australian Business Bank account in Expensify.

---

-## Resource Coming Soon!

+

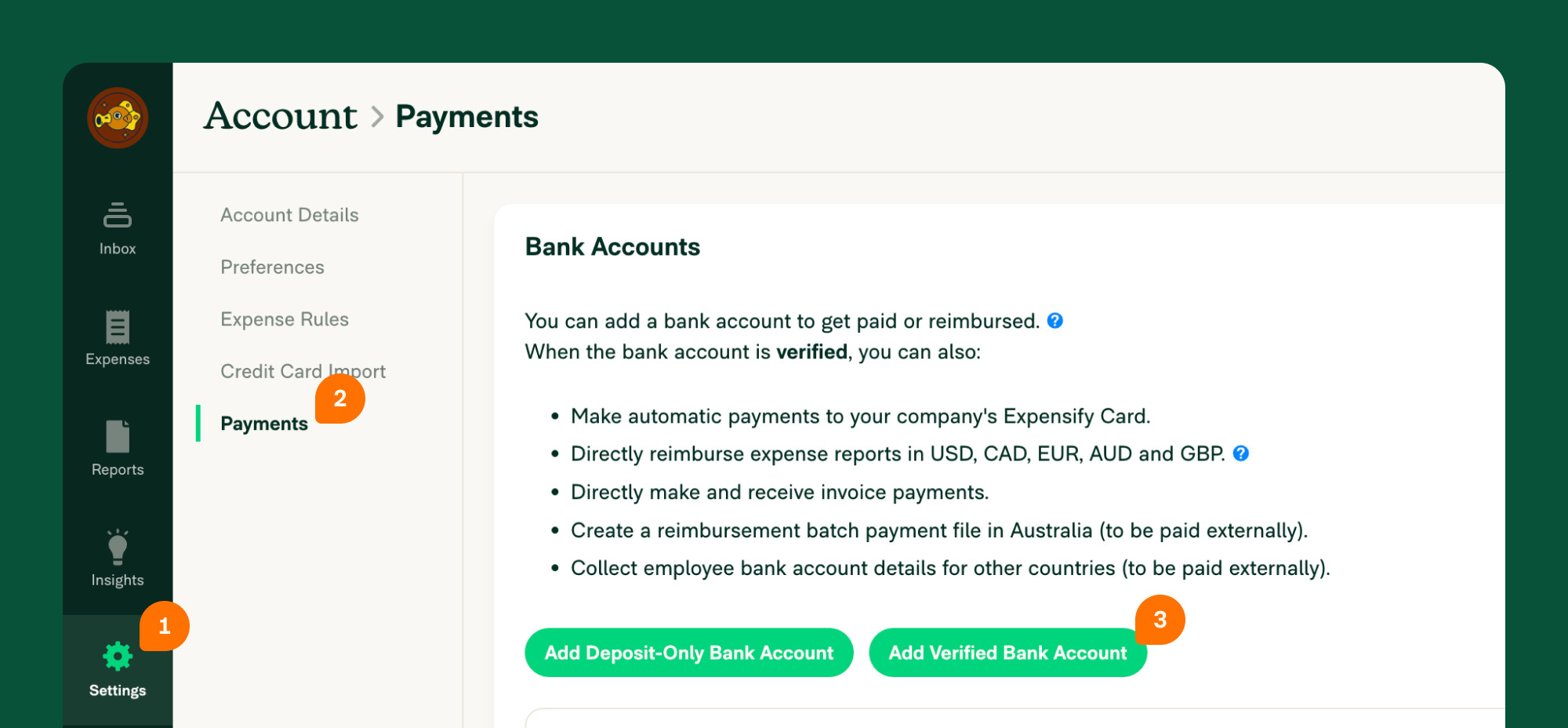

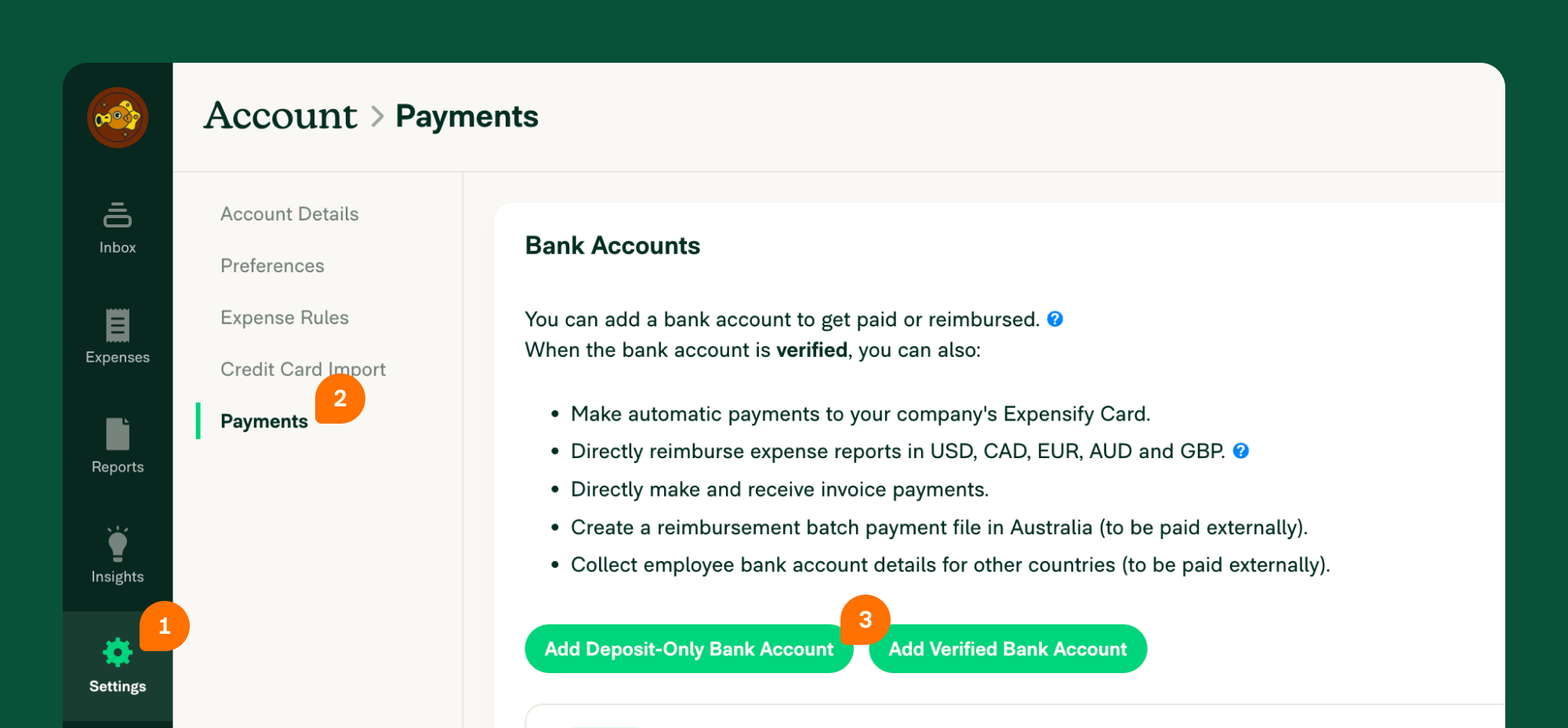

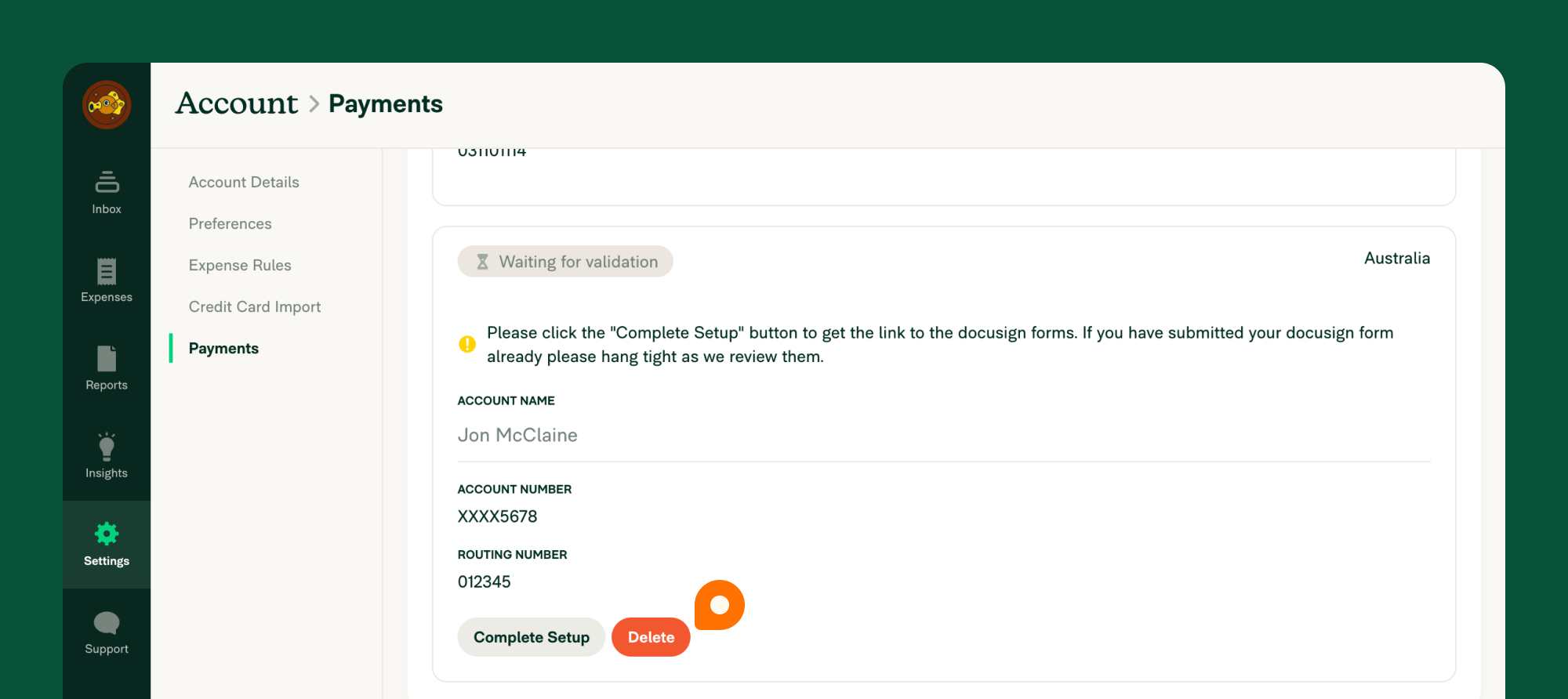

+# How to add an Australian business bank account (for admins)

+A withdrawal account is the business bank account that you want to use to pay your employee reimbursements.

+

+_Your policy currency must be set to AUD and reimbursement setting set to Indirect to continue. If your main policy is used for something other than AUD, then you will need to create a new one and set that policy to AUD._

+

+To set this up, you’ll run through the following steps:

+

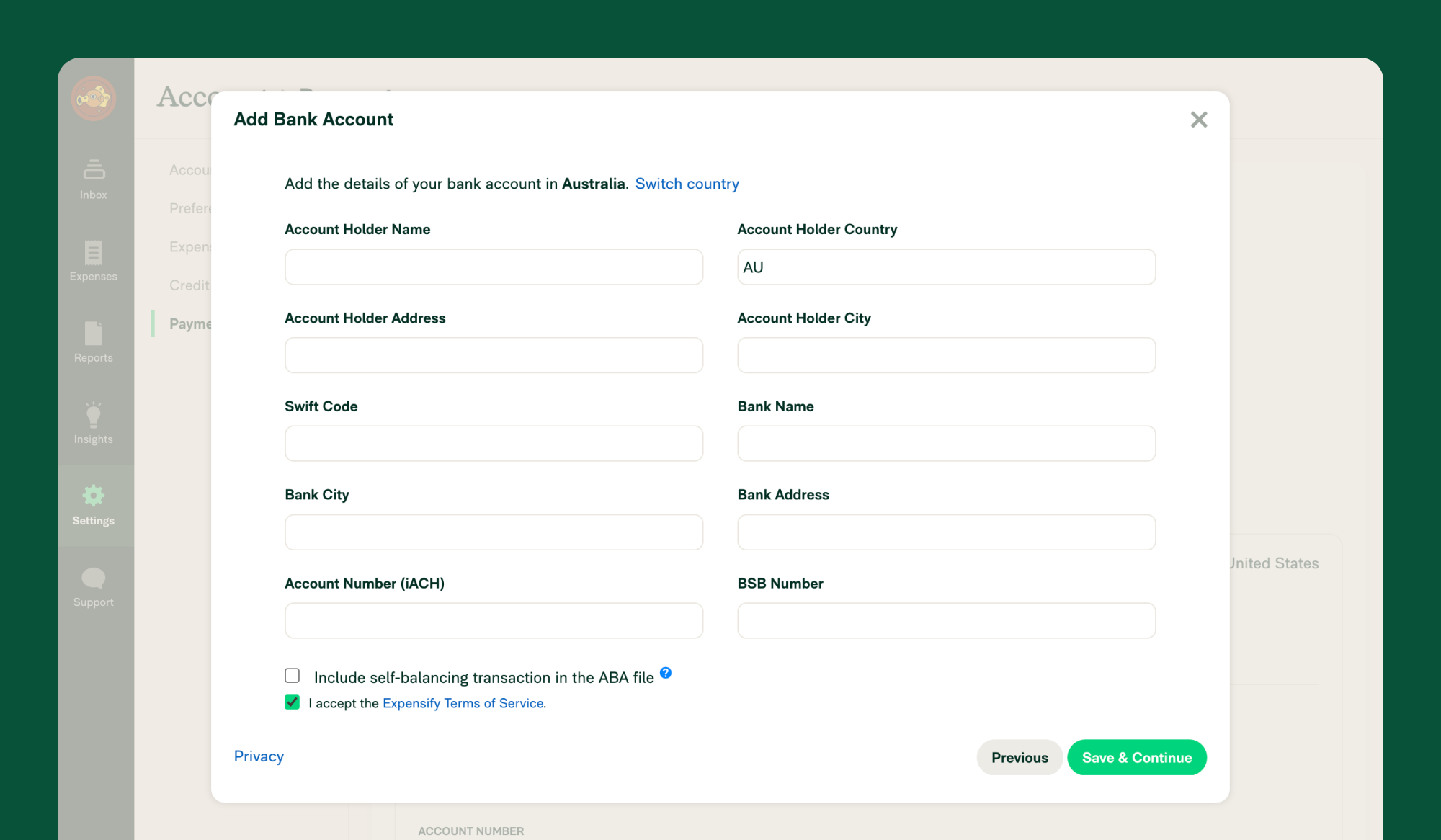

+1. Go to **Settings > Your Account > Payments** and click **Add Verified Bank Account**

+{:width="100%"}

+

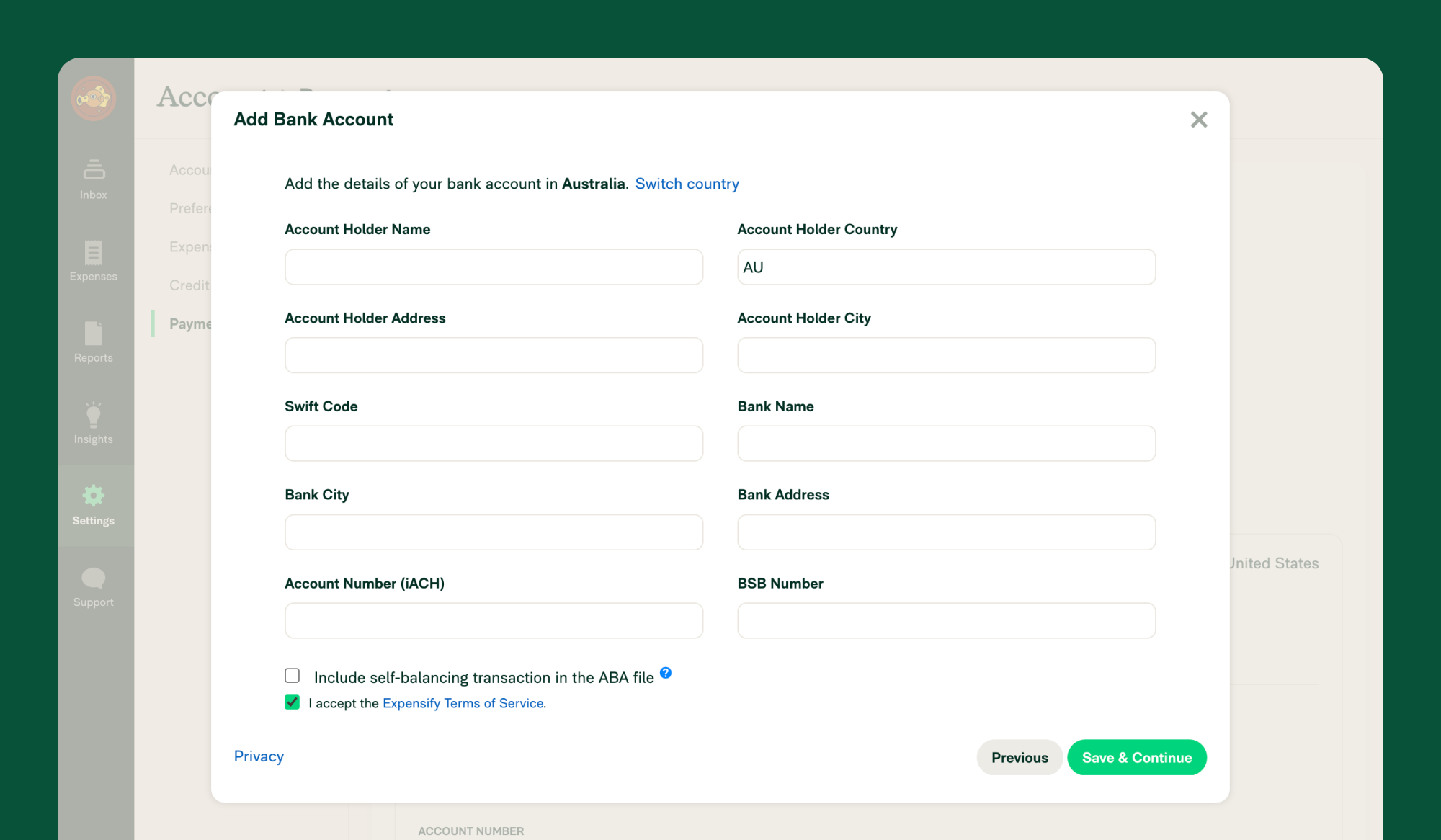

+2. Enter the required information to connect to your business bank account. If you don't know your Bank User ID/Direct Entry ID/APCA Number, please contact your bank and they will be able to provide this.

+{:width="100%"}

+

+3. Link the withdrawal account to your policy by heading to **Settings > Policies > Group > [Policy name] > Reimbursement**

+4. Click **Direct reimbursement**

+5. Set the default withdrawal account for processing reimbursements

+6. Tell your employees to add their deposit accounts and start reimbursing.

+

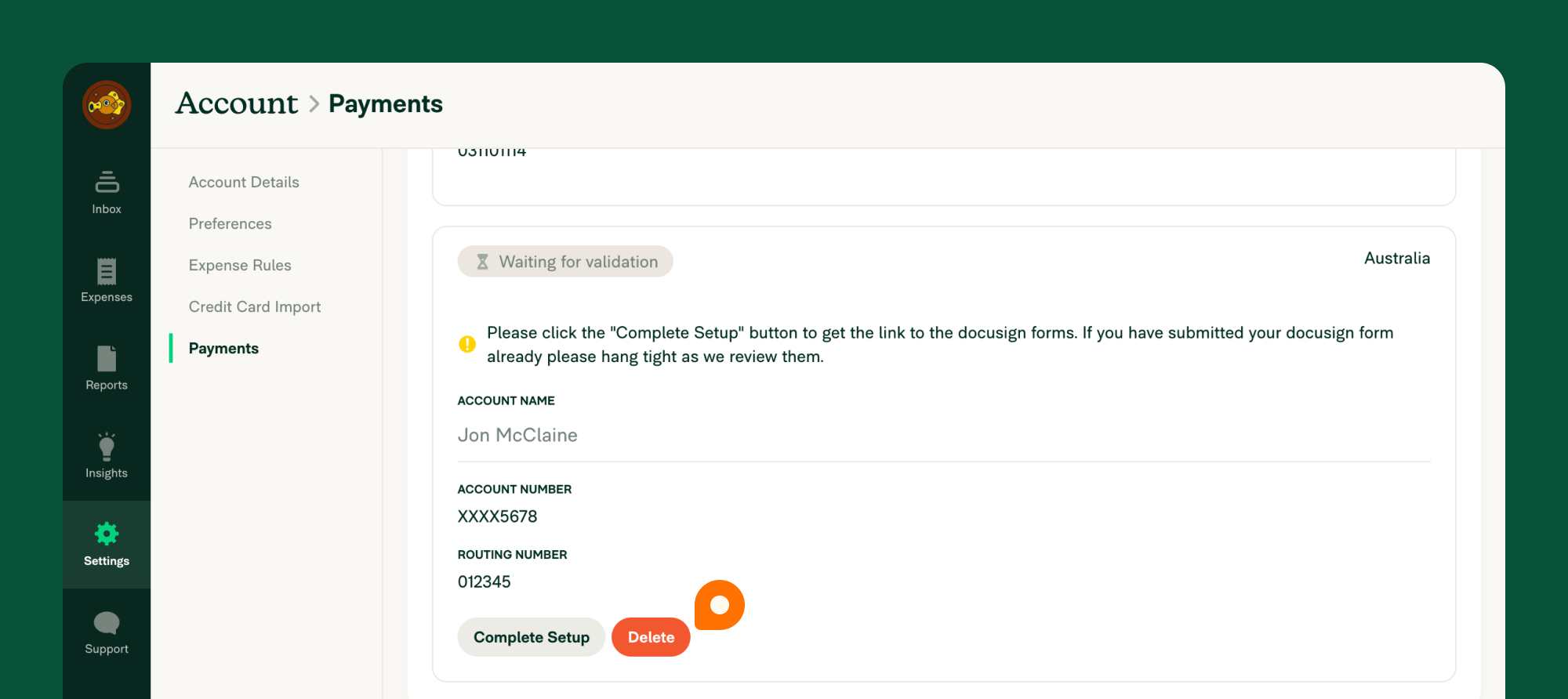

+# How to delete a bank account

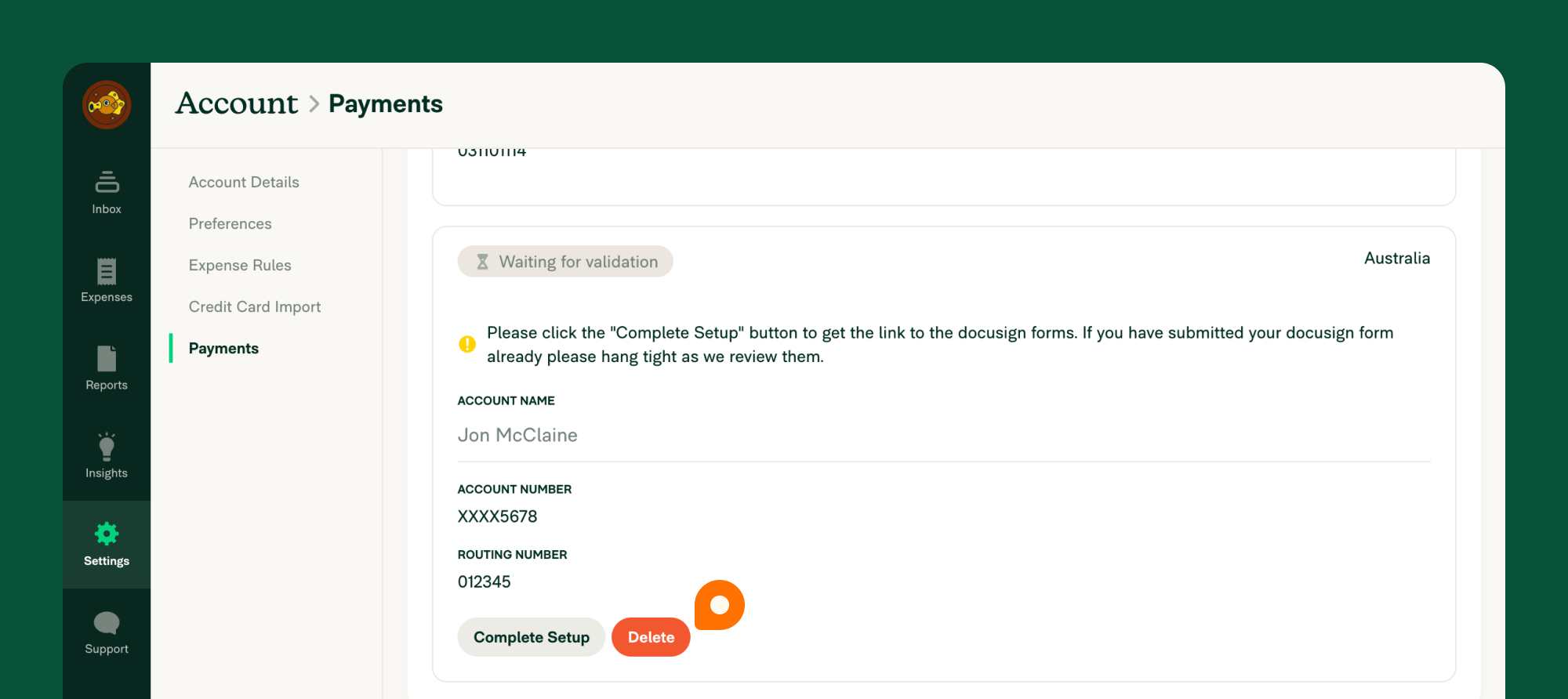

+If you’re no longer using a bank account you previously connected to Expensify, you can delete it by doing the following:

+

+1. Navigate to Settings > Accounts > Payments

+2. Click **Delete**

+{:width="100%"}

+

+You can complete this process either via the web app (on a computer), or via the mobile app.

+

+# Deep Dive

+## Bank-specific batch payment support

+

+If you are new to using Batch Payments in Australia, to reimburse your staff or process payroll, you may want to check out these bank-specific instructions for how to upload your .aba file:

+

+- ANZ Bank - [Import a file for payroll payments](https://www.anz.com.au/support/internet-banking/pay-transfer-business/payroll/import-file/)

+- CommBank - [Importing and using

Direct Entry (EFT) files](https://www.commbank.com.au/business/pds/003-279-importing-a-de-file.pdf)

+- Westpac - [Importing Payment Files](https://www.westpac.com.au/business-banking/online-banking/support-faqs/import-files/)

+- NAB - [Quick Reference Guide - Upload a payment file](https://www.nab.com.au/business/online-banking/nab-connect/help)

+- Bendigo Bank - [Bulk payments user guide](https://www.bendigobank.com.au/globalassets/documents/business/bulk-payments-user-guide.pdf)

+- Bank of Queensland - [Payments file upload facility FAQ](https://www.boq.com.au/help-and-support/online-banking/ob-faqs-and-support/faq-pfuf)

+

+**Note:** Some financial institutions require an ABA file to include a *self-balancing transaction*. If you are unsure, please check with your bank to ensure whether to tick this option or not, as selecting an incorrect option will result in the ABA file not working with your bank's internet banking platform.

+

+## Enable Global Reimbursement

+

+If you have employees in other countries outside of Australia, you can now reimburse them directly using Global Reimbursement.

+

+To do this, you’ll first need to delete any existing Australian business bank accounts. Then, you’ll want to follow the instructions to enable Global Reimbursements

diff --git a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Deposit-Account-(AUD).md b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-AUD.md

similarity index 83%

rename from docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Deposit-Account-(AUD).md

rename to docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-AUD.md

index 7273e5ece879..6114e98883e0 100644

--- a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Deposit-Account-(AUD).md

+++ b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-AUD.md

@@ -1,12 +1,12 @@

---

-title: Add a Deposit Account (AUD)

+title: Deposit Accounts (AUD)

description: Expensify allows you to add a personal bank account to receive reimbursements for your expenses. We never take money out of this account — it is only a place for us to deposit funds from your employer. This article covers deposit accounts for Australian banks.

---

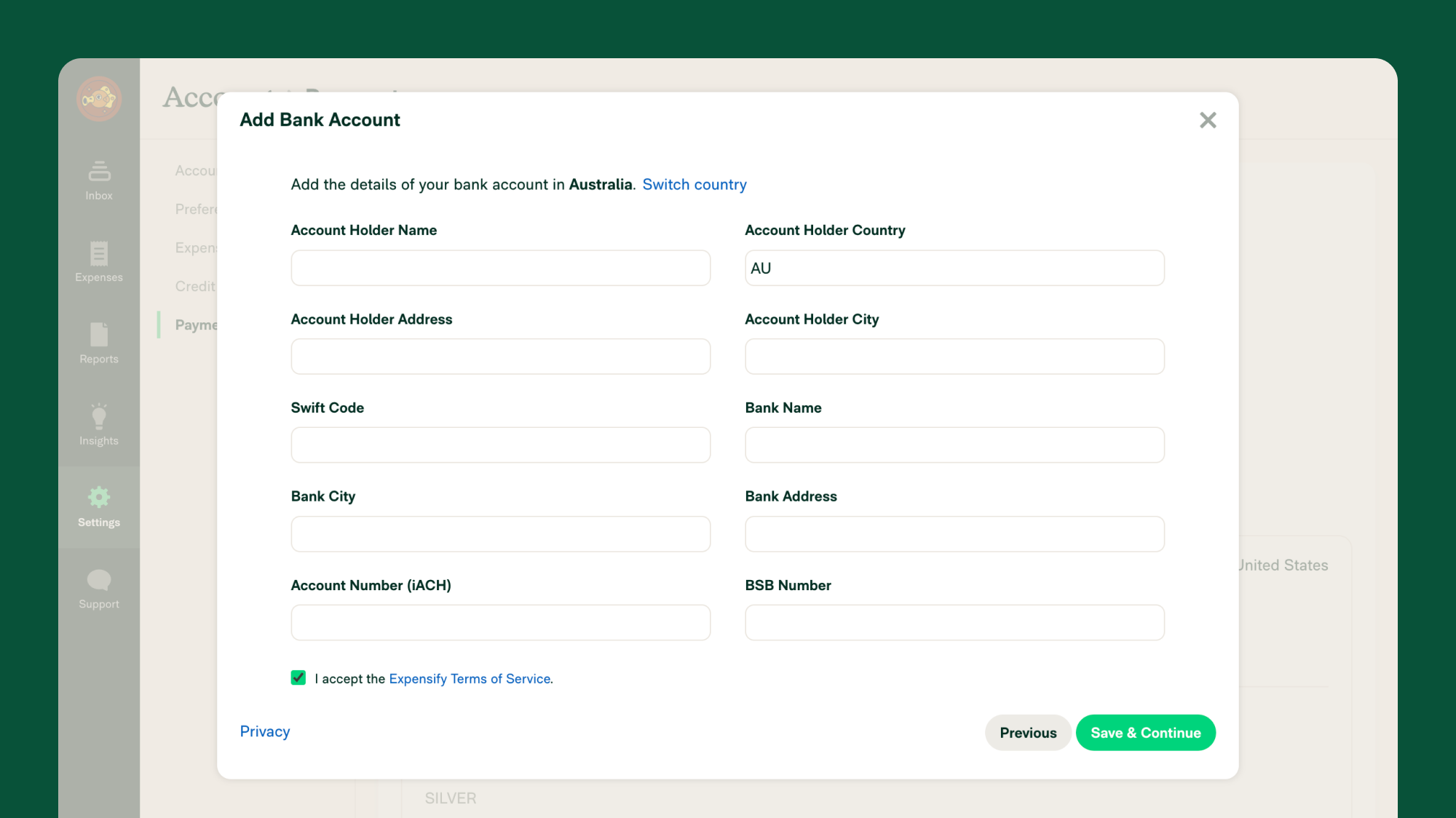

## How-to add your Australian personal deposit account information

1. Confirm with your Policy Admin that they’ve set up Global Reimbursment

2. Set your default policy (by selecting the correct policy after clicking on your profile picture) before adding your deposit account.

-3. Go to *Settings > Account > Payments* and click *Add Deposit-Only Bank Account*

+3. Go to **Settings > Account > Payments** and click **Add Deposit-Only Bank Account**

{:width="100%"}

4. Enter your BSB, account number and name. If your screen looks different than the image below, that means your company hasn't enabled reimbursements through Expensify. Please contact your administrator and ask them to enable reimbursements.

@@ -14,7 +14,7 @@ description: Expensify allows you to add a personal bank account to receive reim

{:width="100%"}

# How-to delete a bank account

-Bank accounts are easy to delete! Simply click the red “Delete” button in the bank account under *Settings > Account > Payments*.

+Bank accounts are easy to delete! Simply click the red **Delete** button in the bank account under **Settings > Account > Payments**.

{:width="100%"}

diff --git a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-AUS.md b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-AUS.md

deleted file mode 100644

index 61e6dfd95e38..000000000000

--- a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-AUS.md

+++ /dev/null

@@ -1,5 +0,0 @@

----

-title: Deposit Accounts - AUD

-description: Deposit Accounts - AUD

----

-## Resource Coming Soon!

diff --git a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-USD.md b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-USD.md

index 19010be95980..a4ff7503f7bb 100644

--- a/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-USD.md

+++ b/docs/articles/expensify-classic/bank-accounts-and-credit-cards/deposit-accounts/Deposit-Accounts-USD.md

@@ -1,5 +1,75 @@

---

title: Deposit Accounts - USD

-description: Deposit Accounts - USD

+description: How to add a deposit account to receive payments for yourself or your business (US)

---

-## Resource Coming Soon!

+# Overview

+

+There are two types of deposit-only accounts:

+

+1. If you're an employee seeking reimbursement for expenses you’ve incurred, you’ll add a **Personal deposit-only bank account**.

+2. If you're a vendor seeking payment for goods or services, you’ll add a **Business deposit-only account**.

+

+# How to connect a personal deposit-only bank account

+

+**Connect a personal deposit-only bank account if you are:**

+

+- An employee based in the US who gets reimbursed by their employer

+- An employee based in Australia who gets reimbursed by their company via batch payments

+- An international (non-US) employee whose US-based employers send international reimbursements

+

+**To establish the connection to a personal bank account, follow these steps:**

+

+1. Navigate to your **Settings > Account > Payments** and click the **Add Deposit-Only Bank Account** button.

+2. Click **Log into your bank** button and click **Continue** on the Plaid connection pop-up window.

+3. Search for your bank account in the list of banks and follow the prompts to sign-in to your bank account.

+4. Enter your bank login credentials when prompted.

+ - If your bank doesn't appear, click the 'x' in the upper right corner of the Plaid pop-up window and click **Connect Manually**.

+ - Enter your account information, then click **Save & Continue**.

+

+You should be all set! You’ll receive reimbursement for your expense reports directly to this bank account.

+

+# How to connect a business deposit-only bank account

+

+**Connect a business deposit-only bank account if you are:**

+

+- A US-based vendor who wants to be paid directly for bills sent to customers/clients

+- A US-based vendor who want to pay invoices directly via Expensify

+

+**To establish the connection to a business bank account, follow these steps:**

+

+1. Navigate to your **Settings > Account > Payments and click the Add Deposit-Only Bank Account** button.

+2. Click **Log into your bank** button and click **Continue** on the Plaid connection pop-up window.

+3. Search for your bank account in the list of banks and follow the prompts to sign-in to your bank account.

+4. Enter your bank login credentials when prompted.

+ - If your bank doesn't appear, click the 'x' in the upper right corner of the Plaid pop-up window and click **Connect Manually**.

+ - Enter your account information, then click **Save & Continue**.

+5. If you see the option to “Switch to Business” after entering the account owner information, click that link.

+6. Enter your Company Name and FEIN or TIN information.

+7. Enter your company’s website formatted as https://www.domain.com.

+

+You should be all set! The bank account will display as a deposit-only business account, and you’ll be paid directly for any invoices you submit for payment.

+

+# How to delete a deposit-only bank account

+

+**To delete a deposit-only bank account, do the following:**

+

+1. Navigate to **Settings > Account > Payments > Bank Accounts**

+2. Click the **Delete** next to the bank account you want to remove

+

+# FAQ

+

+## **What happens if my bank requires an additional security check before adding it to a third-party?**

+

+If your bank account has 2FA enabled or another security step, you should be prompted to complete this when adding the account. If not, and you encounter an error, you can always select the option to “Connect Manually”. Either way, please double check that you are entering the correct bank account details to ensure successful payments.

+

+## **What if I also want to pay employees with my business bank account?**

+

+If you’ve added a business deposit-only account and also wish to also pay employees, vendors, or utilize the Expensify Card with this bank account, select “Verify” on the listed bank account. This will take you through the additional verification steps to use this account to issue payments.

+

+## **I connected my deposit-only bank account – Why haven’t I received my reimbursement?**

+

+There are a few reasons a reimbursement may be unsuccessful. The first step is to review the estimated deposit date on the report. If it’s after that date and you still haven’t seen the funds, it could have been unsuccessful because:

+ - The incorrect account was added. If you believe you may have entered the wrong account, please reach out to Concierge and provide the Report ID for the missing reimbursement.

+ - Your account wasn’t set up for Direct Deposit/ACH. You may want to contact your bank to confirm.

+

+If you aren’t sure, please reach out to Concierge and we can assist!

diff --git a/docs/articles/expensify-classic/expensify-card/Card-Settings.md b/docs/articles/expensify-classic/expensify-card/Card-Settings.md

index ab212354974a..35708b6fbb1e 100644

--- a/docs/articles/expensify-classic/expensify-card/Card-Settings.md

+++ b/docs/articles/expensify-classic/expensify-card/Card-Settings.md

@@ -1,5 +1,169 @@

---

-title: Card Settings

-description: Card Settings

+title: Expensify Card Settings

+description: Admin Card Settings and Features

---

-## Resource Coming Soon!

+## Expensify Card - admin settings and features

+

+# Overview

+

+The Expensify Card offers a range of settings and functionality to customize how admins manage expenses and card usage in Expensify. To start, we'll lay out the best way to make these options work for you.

+

+Set Smart Limits to control card spend. Smart Limits are spend limits that can be set for individual cards or specific groups. Once a given Smart Limit is reached, the card is temporarily disabled until expenses are approved.

+

+Monitor spend using your Domain Limit and the Reconciliation Dashboard.

+Your Domain Limit is the total Expensify Card limit across your entire organization. No member can spend more than what's available here, no matter what their individual Smart Limit is. A Domain Limit is dynamic and depends on a number of factors, which we'll explain below.

+

+Decide the settlement model that works best for your business

+Monthly settlement is when your Expensify Card balance is paid in full on a certain day each month. Though the Expensify Card is set to settle daily by default, any Domain Admin can change this setting to monthly.

+

+Now, let's get into the mechanics of each piece mentioned above.

+

+# How to set Smart Limits

+Smart Limits allow you to set a custom spend limit for each Expensify cardholder, or default limits for groups. Setting a Smart Limit is the step that activates an Expensify card for your user (and issues a virtual card for immediate use).

+

+## Set limits for individual cardholders

+As a Domain Admin, you can set or edit Custom Smart Limits for a card by going to Settings > Domains > Domain Name > Company Cards. Simply click Edit Limit to set the limit. This limit will restrict the amount of unapproved (unsubmitted and Processing) expenses that a cardholder can incur. After the limit is reached, the cardholder won't be able to use their card until they submit outstanding expenses and have their card spend approved. If you set the Smart Limit to $0, the user's card can't be used.

+## Set default group limits

+Domain Admins can set or edit custom Smart Limits for a domain group by going to Settings > Domains > Domain Name > Groups. Just click on the limit in-line for your chosen group and amend the value.

+

+This limit will apply to all members of the Domain Group who do not have an individual limit set via Settings > Domains > Domain Name > Company Cards.

+## Refreshing Smart Limits

+To let cardholders keep spending, you can approve their pending expenses via the Reconciliation tab. This will free up their limit, allowing them to use their card again.

+

+To check an unapproved card balance and approve expenses, click on Reconciliation and enter a date range, then click though the Unapproved total to see what needs approving. You can add to a new report or approve an existing report from here.

+

+You can also increase a Smart Limit at any time by clicking Edit Limit.

+

+# Understanding your Domain Limit

+

+To get the most accurate Domain Limit for your company, connect your bank account via Plaid under Settings > Account > Payments > Add Verified Bank Account.

+

+If your bank isn't supported or you're having connection issues, you can request a custom limit under Settings > Domains > Domain Name > Company Cards > Request Limit Increase. As a note, you'll need to provide three months of unredacted bank statements for review by our risk management team.

+

+Your Domain Limit may fluctuate from time to time based on various factors, including:

+

+- Available funds in your Verified Business Bank Account: We regularly check bank balances via Plaid. A sudden drop in balance within the last 24 hours may affect your limit. For 'sweep' accounts, be sure to maintain a substantial balance even if you're sweeping daily.

+- Pending expenses: Review the Reconciliation Dashboard to check for large pending expenses that may impact your available balance. Your Domain Limit will adjust automatically to include pending expenses.

+- Processing settlements: Settlements need about three business days to process and clear. Several large settlements over consecutive days may impact your Domain Limit, which will dynamically update when settlements have cleared.

+

+As a note, if your Domain Limit is reduced to $0, your cardholders can't make purchases even if they have a larger Smart Limit set on their individual cards.

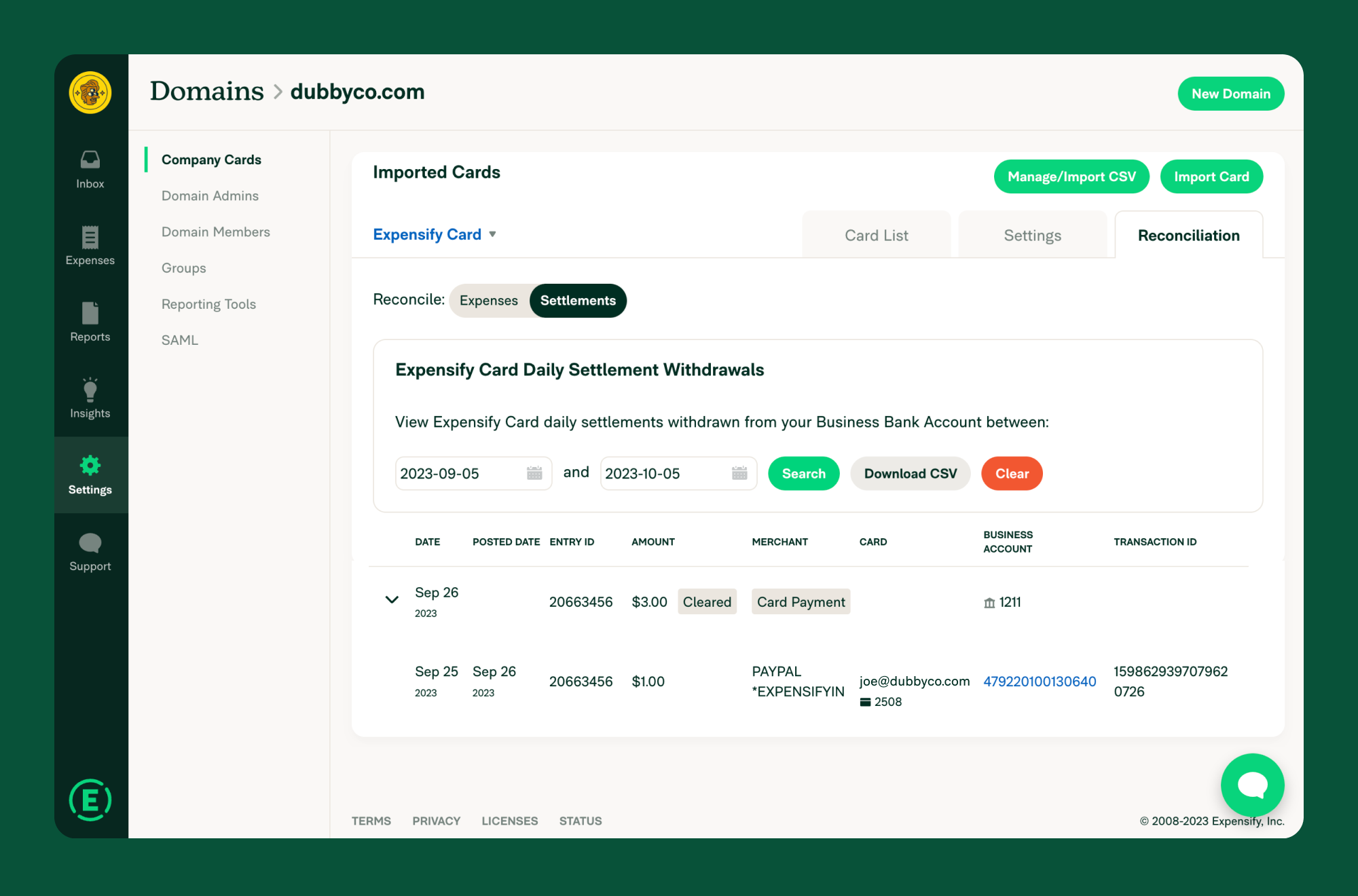

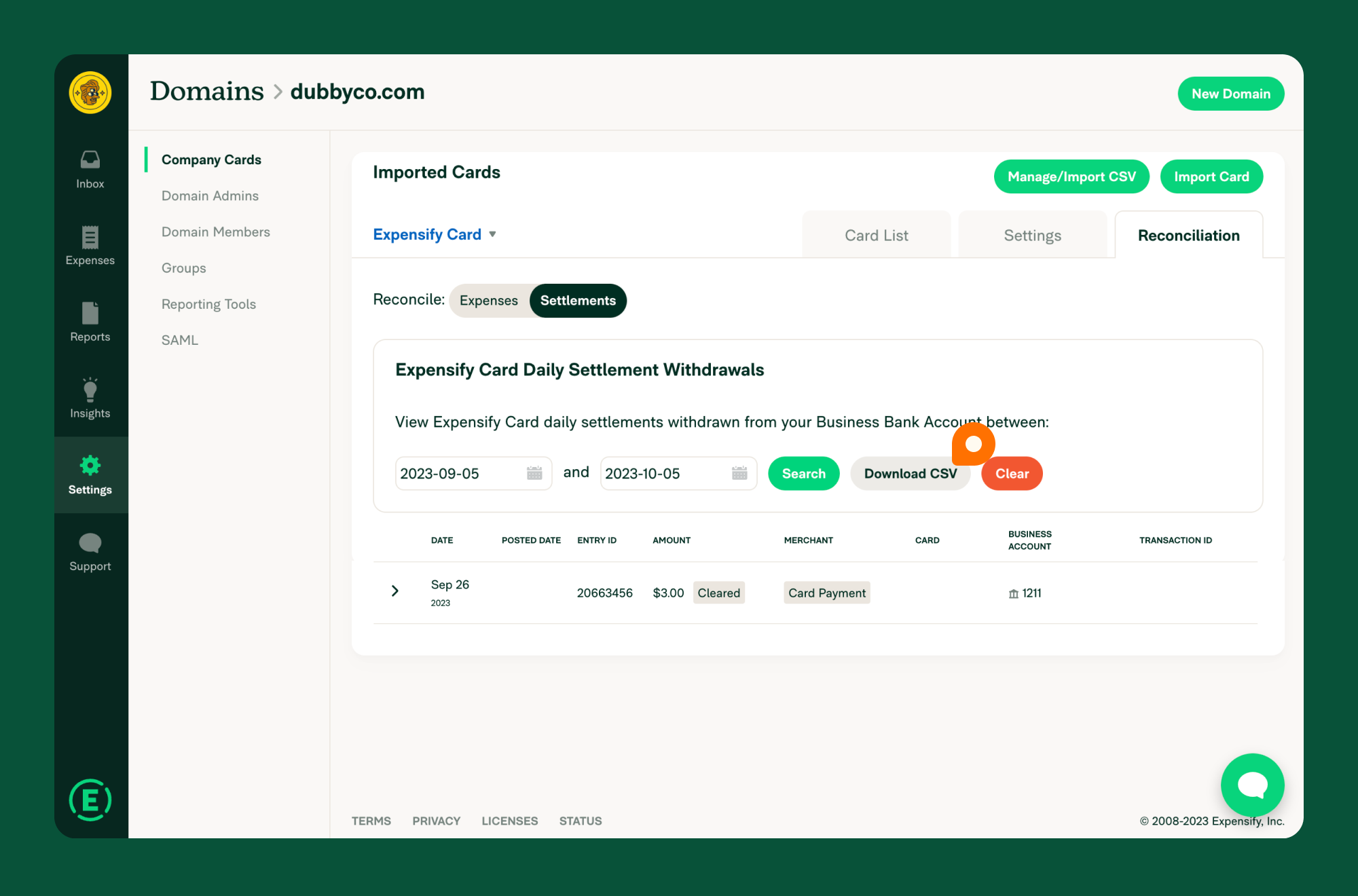

+# How to reconcile Expensify Cards

+## How to reconcile expenses

+Reconciling expenses is essential to ensuring your financial records are accurate and up-to-date.

+

+Follow the steps below to quickly review and reconcile expenses associated with your Expensify Cards:

+

+1. Go to Settings > Domains > Domain Name > Company Cards > Reconciliation > Expenses

+2. Enter your start and end dates, then click Run

+3. The Imported Total will show all Expensify Card transactions for the period

+4. You'll also see a list of all Expensify Cards, the total spend on each card, and a snapshot of expenses that have and have not been approved (Approved Total and Unapproved Total, respectively)

+By clicking on the amounts, you can view the associated expenses

+

+## How to reconcile settlements

+A settlement is the payment to Expensify for the purchases made using the Expensify Cards.

+

+The Expensify Card program can settle on either a daily or monthly basis. One thing to note is that not all transactions in a settlement will be approved when running reconciliation.

+

+You can view the Expensify Card settlements under Settings > Domains > Domain Name > Company Cards > Reconciliation > Settlements.

+

+By clicking each settlement amount, you can see the transactions contained in that specific payment amount.

+

+Follow the below steps to run reconciliation on the Expensify Card settlements:

+

+1. Log into the Expensify web app

+2. Click Settings > Domains > Domain Name > Company Cards > Reconciliation tab > Settlements

+3. Use the Search function to generate a statement for the specific period you need

+4. The search results will include the following info for each entry:

+ - Date: when a purchase was made or funds were debited for payments

+ - Posted Date: when the purchase transaction posted

+ - Entry ID: a unique number grouping card payments and transactions settled by those payments

+ - Amount: the amount debited from the Business Bank Account for payments

+ - Merchant: the business where a purchase was made

+ - Card: refers to the Expensify credit card number and cardholder's email address

+ - Business Account: the business bank account connected to Expensify that the settlement is paid from

+ - Transaction ID: a special ID that helps Expensify support locate transactions if there's an issue

+

+5. Review the individual transactions (debits) and the payments (credits) that settled them

+6. Every cardholder will have a virtual and a physical card listed. They're handled the same way for settlements, reconciliation, and exporting.

+7. Click Download CSV for reconciliation

+8. This will list everything that you see on screen

+9. To reconcile pre-authorizations, you can use the Transaction ID column in the CSV file to locate the original purchase

+10. Review account payments

+11. You'll see payments made from the accounts listed under Settings > Account > Payments > Bank Accounts. Payment data won't show for deleted accounts.

+

+You can use the Reconciliation Dashboard to confirm the status of expenses that are missing from your accounting system. It allows you to view both approved and unapproved expenses within your selected date range that haven't been exported yet.

+

+# Deep dive

+## Set a preferred workspace

+Some customers choose to split their company card expenses from other expense types for coding purposes. Most commonly this is done by creating a separate workspace for card expenses.

+

+You can use the preferred workspace feature in conjunction with Scheduled Submit to make sure all newly imported card expenses are automatically added to reports connected to your card-specific workspace.

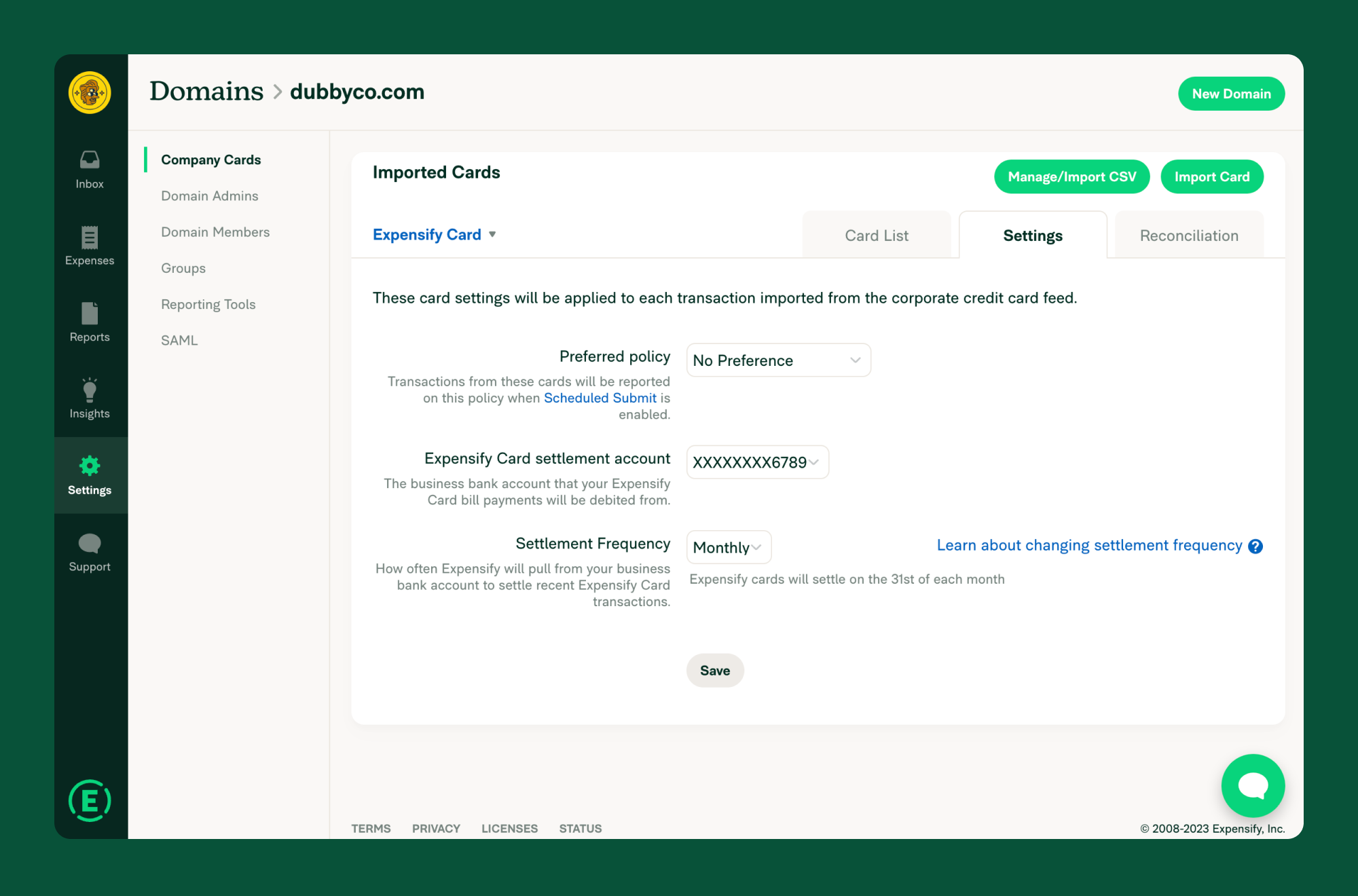

+## How to change your settlement account

+You can change your settlement account to any other verified business bank account in Expensify. If your bank account is closing, make sure you set up the replacement bank account in Expensify as early as possible.

+

+To select a different settlement account:

+

+1. Go to Settings > Domains > Domain Name > Company Cards > Settings tab

+2. Use the Expensify Card settlement account dropdown to select a new account

+3. Click Save

+

+## Change the settlement frequency

+

+By default, the Expensify Cards settle on a daily cadence. However, you can choose to have the cards settle on a monthly basis.

+

+1. Monthly settlement is only available if the settlement account hasn't had a negative balance in the last 90 days

+2. There will be an initial settlement to settle any outstanding spend that happened before switching the settlement frequency

+3. The date that the settlement is changed to monthly is the settlement date going forward (e.g. If you switch to monthly settlement on September 15th, Expensify Cards will settle on the 15th of each month going forward)

+

+To change the settlement frequency:

+1. Go to Settings > Domains > Domain Name > Company Cards > Settings tab

+2. Click the Settlement Frequency dropdown and select Monthly

+3. Click Save to confirm the change

+

+

+## Declined Expensify Card transactions

+As long as you have 'Receive realtime alerts' enabled, you'll get a notification explaining the decline reason. You can enable alerts in the mobile app by clicking on three-bar icon in the upper-left corner > Settings > toggle Receive realtime alerts on.

+

+If you ever notice any unfamiliar purchases or need a new card, go to Settings > Account > Credit Card Import and click on Request a New Card right away.

+

+Here are some reasons an Expensify Card transaction might be declined:

+

+1. You have an insufficient card limit

+ - If a transaction amount exceeds the available limit on your Expensify Card, the transaction will be declined. It's essential to be aware of the available balance before making a purchase to avoid this - you can see the balance under Settings > Account > Credit Card Import on the web app or mobile app. Submitting expenses and having them approved will free up your limit for more spend.

+

+2. Your card hasn't been activated yet, or has been canceled

+ - If the card has been canceled or not yet activated, it won't process any transactions.

+

+3. Your card information was entered incorrectly. Entering incorrect card information, such as the CVC, ZIP or expiration date will also lead to declines.

+

+4. There was suspicious activity

+ - If Expensify detects unusual or suspicious activity, we may block transactions as a security measure. This could happen due to irregular spending patterns, attempted purchases from risky vendors, or multiple rapid transactions. Check your Expensify Home page to approve unsual merchants and try again.

+ If the spending looks suspicious, we may do a manual due diligence check, and our team will do this as quickly as possible - your cards will all be locked while this happens.

+

+5. The merchant is located in a restricted country

+ - Some countries may be off-limits for transactions. If a merchant or their headquarters (billing address) are physically located in one of these countries, Expensify Card purchases will be declined. This list may change at any time, so be sure to check back frequently: Belarus, Burundi, Cambodia, Central African Republic, Democratic Republic of the Congo, Cuba, Iran, Iraq, North Korea, Lebanon, Libya, Russia, Somalia, South Sudan, Syrian Arab Republic, Tanzania, Ukraine, Venezuela, Yemen, and Zimbabwe.

+

+# FAQ

+## What happens when I reject an Expensify Card expense?

+

+

+Rejecting an Expensify Card expense from an Expensify report will simply allow it to be reported on a different report. You cannot undo a credit card charge.

+

+If an Expensify Card expense needs to be rejected, you can reject the report or the specific expense so it can be added to a different report. The rejected expense will become Unreported and return to the submitter's Expenses page.

+

+If you want to dispute a card charge, please message Concierge to start the dispute process.

+

+If your employee has accidentally made an unauthorised purchase, you will need to work that out with the employee to determine how they will pay back your company.

+

+

+## What happens when an Expensify Card transaction is refunded?

+

+

+The way a refund is displayed in Expensify depends on the status of the expense (pending or posted) and whether or not the employee also submitted an accompanying SmartScanned receipt. Remember, a SmartScanned receipt will auto-merge with the Expensify Card expense.

+

+- Full refunds:

+If a transaction is pending and doesn't have a receipt attached (except for eReceipts), getting a full refund will make the transaction disappear.

+If a transaction is pending and has a receipt attached (excluding eReceipts), a full refund will zero-out the transaction (amount becomes zero).

+- Partial refunds:

+If a transaction is pending, a partial refund will reduce the amount of the transaction.

+- If a transaction is posted, a partial refund will create a negative transaction for the refund amount.

diff --git a/docs/articles/expensify-classic/expensify-card/Statements.md b/docs/articles/expensify-classic/expensify-card/Statements.md

index b48d303a1a9b..5b583370b810 100644

--- a/docs/articles/expensify-classic/expensify-card/Statements.md

+++ b/docs/articles/expensify-classic/expensify-card/Statements.md

@@ -1,5 +1,73 @@

---

-title: Statements

-description: Statements

+title: — Expensify Card Statements and Settlements

+description: Learn how the Expensify Card statement and settlements work!

---

-## Resource Coming Soon!

+

+# Overview

+Expensify offers several settlement types and a statement that provides a detailed view of transactions and settlements. We discuss specifics on both below.

+

+# How to use Expensify Card Statement and Settlements

+## Using the statement

+If your domain uses the Expensify Card and you have a validated Business Bank Account, access the Expensify Card statement at Settings > Domains > Company Cards > Reconciliation Tab > Settlements.

+

+The Expensify Card statement displays individual transactions (debits) and their corresponding settlements (credits). Each Expensify Cardholder has a Digital Card and a Physical Card, which are treated the same in settlement, reconciliation, and exporting to your accounting system.

+

+Here's a breakdown of crucial information in the statement:

+- **Date:** For card payments, it shows the debit date; for card transactions, it displays the purchase date.

+- **Entry ID:** This unique ID groups card payments and transactions together.

+- **Withdrawn Amount:** This applies to card payments, matching the debited amount from the Business Bank Account.

+- **Transaction Amount:** This applies to card transactions, matching the expense purchase amount.

+- **User email:** Applies to card transactions, indicating the cardholder's Expensify email address.

+- **Transaction ID:** A unique ID for locating transactions and assisting Expensify Support in case of issues. Transaction IDs are handy for reconciling pre-authorizations. To find the original purchase, locate the Transaction ID in the Settlements tab of the reconciliation dashboard, download the settlements as a CSV, and search for the Transaction ID within it.

+

+{:width="100%"}

+

+The Expensify Card statement only shows payments from existing Business Bank Accounts under Settings > Account > Payments > Business Accounts. If a Business Account is deleted, the statement won't contain data for payments from that account.

+

+## Exporting your statement

+When using the Expensify Card, you can export your statement to a CSV with these steps:

+

+ 1. Login to your account on the web app and click on Settings > Domains > Company Cards.

+ 2. Click the Reconciliation tab at the top right, then select Settlements.

+ 3. Enter your desired statement dates using the Start and End fields.

+ 4. Click Search to access the statement for that period.

+ 5. You can view the table or select Download to export it as a CSV.

+

+{:width="100%"}

+

+## Expensify Card Settlement Frequency

+Paying your Expensify Card balance is simple with automatic settlement. There are two settlement frequency options:

+ - **Daily Settlement:** Your Expensify Card balance is paid in full every business day, meaning you’ll see an itemized debit each business day.

+ - **Monthly Settlement:** Expensify Cards are settled monthly, with your settlement date determined during the card activation process. With monthly, you’ll see only one itemized debit per month. (Available for Plaid-connected bank accounts with no recent negative balance.)

+

+## How settlement works

+Each business day (Monday through Friday, excluding US bank holidays) or on your monthly settlement date, we calculate the total of posted Expensify Card transactions since the last settlement. The settlement amount represents what you must pay to bring your Expensify Card balance back to $0.

+

+We'll automatically withdraw this settlement amount from the Verified Business Bank Account linked to the primary domain admin. You can set up this bank account in the web app under Settings > Account > Payments > Bank Accounts.

+

+Once the payment is made, your Expensify Card balance will be $0, and the transactions are considered "settled."

+

+To change your settlement frequency or bank account, go to Settings > Domains > [Domain Name] > Company Cards. On the Company Cards page, click the Settings tab, choose a new settlement frequency or account from the dropdown menu, and click Save to confirm the change.

+

+{:width="100%"}

+

+# Expensify Card Statement and Settlements FAQs

+## Can you pay your balance early if you've reached your Domain Limit?

+If you've chosen Monthly Settlement, you can manually initiate settlement using the "Settle Now" button. We'll settle the outstanding balance and then perform settlement again on your selected predetermined monthly settlement date.

+

+If you opt for Daily Settlement, the Expensify Card statement will automatically settle daily through an automatic withdrawal from your business bank account. No additional action is needed on your part.

+

+## Will our domain limit change if our Verified Bank Account has a higher balance?

+Your domain limit may fluctuate based on your cash balance, spending patterns, and history with Expensify. Suppose you've recently transferred funds to the business bank account linked to Expensify card settlements. In that case, you should expect a change in your domain limit within 24 hours of the transfer (assuming your business bank account is connected through Plaid).

+

+## How is the “Amount Owed” figure on the card list calculated?

+The amount owed consists of all Expensify Card transactions, both pending and posted, since the last settlement date. The settlement amount withdrawn from your designated Verified Business Bank Account only includes posted transactions.

+

+Your amount owed decreases when the settlement clears. Any pending transactions that don't post timely will automatically expire, reducing your amount owed.

+

+## **How do I view all unsettled expenses?**

+To view unsettled expenses since the last settlement, use the Reconciliation Dashboard's Expenses tab. Follow these steps:

+ 1. Note the dates of expenses in your last settlement.

+ 2. Switch to the Expenses tab on the Reconciliation Dashboard.

+ 3. Set the start date just after the last settled expenses and the end date to today.

+ 4. The Imported Total will show the outstanding amount, and you can click through to view individual expenses.

diff --git a/docs/articles/new-expensify/exports/Coming-Soon.md b/docs/articles/expensify-classic/expensify-partner-program/Coming-Soon.md

similarity index 100%

rename from docs/articles/new-expensify/exports/Coming-Soon.md

rename to docs/articles/expensify-classic/expensify-partner-program/Coming-Soon.md

diff --git a/docs/articles/expensify-classic/getting-started/playbooks/Expensify-Playbook-For-Small-To-Medium-Sized-Businesses.md b/docs/articles/expensify-classic/getting-started/playbooks/Expensify-Playbook-For-Small-To-Medium-Sized-Businesses.md

index a7553e6ae179..d933e66cc2d1 100644

--- a/docs/articles/expensify-classic/getting-started/playbooks/Expensify-Playbook-For-Small-To-Medium-Sized-Businesses.md

+++ b/docs/articles/expensify-classic/getting-started/playbooks/Expensify-Playbook-For-Small-To-Medium-Sized-Businesses.md

@@ -3,18 +3,18 @@ title: Expensify Playbook for Small to Medium-Sized Businesses

description: Best practices for how to deploy Expensify for your business

redirect_from: articles/playbooks/Expensify-Playbook-for-Small-to-Medium-Sized-Businesses/

---

-## Overview

+# Overview

This guide provides practical tips and recommendations for small businesses with 100 to 250 employees to effectively use Expensify to improve spend visibility, facilitate employee reimbursements, and reduce the risk of fraudulent expenses.

- See our [US-based VC-Backed Startups](https://help.expensify.com/articles/playbooks/Expensify-Playbook-for-US-based-VC-Backed-Startups) if you are more concerned with top-line revenue growth

-## Who you are

+# Who you are

As a small to medium-sized business owner, your main aim is to achieve success and grow your business. To achieve your goals, it is crucial that you make worthwhile investments in both your workforce and your business processes. This means providing your employees with the resources they need to generate revenue effectively, while also adopting measures to guarantee that expenses are compliant.

-## Step-by-step instructions for setting up Expensify

+# Step-by-step instructions for setting up Expensify

This playbook is built on best practices we’ve developed after processing expenses for tens of thousands of companies around the world. As such, use this playbook as your starting point, knowing that you can customize Expensify to suit your business needs. Every company is different, and your dedicated Setup Specialist is always one chat away with any questions you may have.

-### Step 1: Create your Expensify account

+## Step 1: Create your Expensify account

If you don't already have one, go to *[new.expensify.com](https://new.expensify.com)* and sign up for an account with your work email address. The account is free so don’t worry about the cost at this stage.

> _Employees really appreciate how easy it is to use, and the fact that the reimbursement drops right into their bank account. Since most employees are submitting expenses from their phones, the ease of use of the app is critical_

@@ -22,7 +22,7 @@ If you don't already have one, go to *[new.expensify.com](https://new.expensify.

> **Robyn Gresham**

> Senior Accounting Systems Manager at SunCommon

-### Step 2: Create a Control Policy

+## Step 2: Create a Control Policy

There are three policy types, but for your small business needs we recommend the *Control Plan* for the following reasons:

- *The Control Plan* is designed for organizations with a high volume of employee expense submissions, who also rely on compliance controls

@@ -40,7 +40,7 @@ To create your Control Policy:

The Control Plan also gives you access to a dedicated Setup Specialist. You can find yours by looking at your policy's *#admins* room in *[new.expensify.com](https://new.expensify.com)*, and in your company’s policy settings in the *Overview* tab, where you can chat with them and schedule an onboarding call to walk through any setup questions. The Control Plan bundled with the Expensify Card is only *$9 per user per month* (not taking into account cash back your earn) when you commit annually. That’s a 75% discount off the unbundled price point if you choose to use a different Corporate Card (or no) provider.

-### Step 3: Connect your accounting system

+## Step 3: Connect your accounting system

As a small to medium-sized business, it's important to maintain proper spend management to ensure the success and stability of your organization. This requires paying close attention to your expenses, streamlining your financial processes, and making sure that your financial information is accurate, compliant, and transparent. Include best practices such as:

- Every purchase is categorized into the correct account in your chart of accounts

@@ -65,7 +65,7 @@ Check out the links below for more information on how to connect to your account

*“Employees really appreciate how easy it is to use, and the fact that the reimbursement drops right into their bank account. Since most employees are submitting expenses from their phones, the ease of use of the app is critical.”*

- Robyn Gresham, Senior Accounting Systems Manager at SunCommon

-### Step 4: Set category-specific compliance controls

+## Step 4: Set category-specific compliance controls

Head over to the *Categories* tab to set compliance controls on your newly imported list of categories. More specifically, we recommend the following:

1. First, enable *People Must Categorize Expenses*. Employees must select a category for each expense, otherwise, in most cases, it’s more work on you and our accounting connections will simply reject any attempt to export.

@@ -78,7 +78,7 @@ Head over to the *Categories* tab to set compliance controls on your newly impor

3. Disable any irrelevant expense categories that aren’t associated with employee spend

4. Configure *auto-categorization*, located just below your category list in the same tab. The section is titled *Default Categories*. Just find the right category, and match it with the presented category groups to allow for MCC (merchant category code) automated category selection with every imported connected card transaction.

-### Step 5: Make sure tags are required, or defaults are set

+## Step 5: Make sure tags are required, or defaults are set

Tags in Expensify often relate to departments, projects/customers, classes, and so on. And in some cases they are *required* to be selected on every transactions. And in others, something like *departments* is a static field, meaning we could set it as an employee default and not enforce the tag selection with each expense.

*Make Tags Required*

@@ -89,7 +89,7 @@ In the tags tab in your policy settings, you’ll notice the option to enable th

*Set Tags as an Employee Default*

Separately, if your policy is connected to NetSuite or Sage Intacct, you can set departments, for example, as an employee default. All that means is we’ll apply the department (for example) that’s assigned to the employee record in your accounting package and apply that to every exported transaction, eliminating the need for the employee to have to manually select a department for each expense.

-### Step 6: Set rules for all expenses regardless of categorization

+## Step 6: Set rules for all expenses regardless of categorization

In the Expenses tab in your group Control policy, you’ll notice a *Violations* section designed to enforce top-level compliance controls that apply to every expense, for every employee in your policy. We recommend the following confiuration:

*Max Expense Age: 90 days (or leave it blank)*

@@ -105,7 +105,7 @@ Receipts are important, and in most cases you prefer an itemized receipt. Howeve

At this point, you’ve set enough compliance controls around categorical spend and general expenses for all employees, such that you can put trust in our solution to audit all expenses up front so you don’t have to. Next, let’s dive into how we can comfortably take on more automation, while relying on compliance controls to capture bad behavior (or better yet, instill best practices in our employees).

-### Step 7: Set up scheduled submit

+## Step 7: Set up scheduled submit

For an efficient company, we recommend setting up [Scheduled Submit](https://community.expensify.com/discussion/4476/how-to-enable-scheduled-submit-for-a-group-policy) on a *Daily* frequency:

- Click *Settings > Policies*

@@ -125,7 +125,7 @@ Expenses with violations will stay behind for the employee to fix, while expense

> Kevin Valuska

> AP/AR at Road Trippers

-### Step 8: Connect your business bank account (US only)

+## Step 8: Connect your business bank account (US only)

If you’re located in the US, you can utilize Expensify’s payment processing and reimbursement features.

*Note:* Before you begin, you’ll need the following to validate your business bank account:

@@ -145,7 +145,7 @@ Let’s walk through the process of linking your business bank account:

You only need to do this once: you are fully set up for not only reimbursing expense reports, but issuing Expensify Cards, collecting customer invoice payments online (if applicable), as well as paying supplier bills online.

-### Step 9: Invite employees and set an approval workflow

+## Step 9: Invite employees and set an approval workflow

*Select an Approval Mode*

We recommend you select *Advanced Approval* as your Approval Mode to set up a middle-management layer of a approval. If you have a single layer of approval, we recommend selecting [Submit & Approve](https://community.expensify.com/discussion/5643/deep-dive-submit-and-approve). But if *Advanced Approval* if your jam, keep reading!

@@ -159,13 +159,13 @@ In most cases, at this stage, approvers prefer to review all expenses for a few

In this case we recommend setting *Manually approve all expenses over: $0*

-### Step 10: Configure Auto-Approval

+## Step 10: Configure Auto-Approval

Knowing you have all the control you need to review reports, we recommend configuring auto-approval for *all reports*. Why? Because you’ve already put reports through an entire approval workflow, and manually triggering reimbursement is an unnecessary action at this stage.

1. Navigate to *Settings > Policies > Group > [Policy Name] > Reimbursement*

2. Set your *Manual Reimbursement threshold to $20,0000*

-### Step 11: Enable Domains and set up your corporate card feed for employees

+## Step 11: Enable Domains and set up your corporate card feed for employees

Expensify is optimized to work with corporate cards from all banks – or even better, use our own perfectly integrated *[Expensify Card](https://use.expensify.com/company-credit-card)*. The first step for connecting to any bank you use for corporate cards, and the Expensify Card is to validate your company’s domain in Domain settings.

To do this:

@@ -173,7 +173,7 @@ To do this:

- Click *Settings*

- Then select *Domains*

-#### If you have an existing corporate card

+### If you have an existing corporate card

Expensify supports direct card feeds from most financial institutions. Setting up a corporate card feed will pull in the transactions from the connected cards on a daily basis. To set this up, do the following:

1. Go to *Company Cards >* Select your bank

@@ -187,7 +187,7 @@ Expensify supports direct card feeds from most financial institutions. Setting u

As mentioned above, we’ll be able to pull in transactions as they post (daily) and handle receipt matching for you and your employees. One benefit of the Expensify Card for your company is being able to see transactions at the point of purchase which provides you with real-time compliance. We even send users push notifications to SmartScan their receipt when it’s required and generate IRS-compliant e-receipts as a backup wherever applicable.

-#### If you don't have a corporate card, use the Expensify Card (US only)

+### If you don't have a corporate card, use the Expensify Card (US only)

Expensify provides a corporate card with the following features:

- Up to 2% cash back (up to 4% in your first 3 months!)

@@ -214,7 +214,7 @@ Once the Expensify Cards have been assigned, each employee will be prompted to e

If you have an accounting system we directly integrate with, check out how we take automation a step further with [Continuous Reconciliation](https://community.expensify.com/discussion/7335/faq-what-is-the-expensify-card-auto-reconciliation-process). We’ll create an Expensify Card clearing and liability account for you. Each time settlement occurs, we’ll take the total amount of your purchases and create a journal entry that credits the settlement account and debits the liability account - saving you hours of manual reconciliation work at the end of your statement period.

-### Step 12: Set up Bill Pay and Invoicing

+## Step 12: Set up Bill Pay and Invoicing

As a small business, managing bills and invoices can be a complex and time-consuming task. Whether you receive bills from vendors or need to invoice clients, it's important to have a solution that makes the process simple, efficient, and cost-effective.

Here are some of the key benefits of using Expensify for bill payments and invoicing:

@@ -246,7 +246,7 @@ Reports, invoices, and bills are largely the same, in theory, just with differen

You’ll notice it’s a slightly different flow from creating a Bill. Here, you are adding the transactions tied to the Invoice, and establishing a due date for when it needs to get paid. If you need to apply any markups, you can do so from your policy settings under the Invoices tab. Your customers can pay their invoice in Expensify via ACH, or Check, or Credit Card.

-### Step 13: Run monthly, quarterly and annual reporting

+## Step 13: Run monthly, quarterly and annual reporting

At this stage, reporting is important and given that Expensify is the primary point of entry for all employee spend, we make reporting visually appealing and wildly customizable.

1. Head to the *Expenses* tab on the far left of your left-hand navigation

@@ -261,7 +261,7 @@ We recommend reporting:

{:width="100%"}

-### Step 14: Set your Subscription Size and Add a Payment card

+## Step 14: Set your Subscription Size and Add a Payment card

Our pricing model is unique in the sense that you are in full control of your billing. Meaning, you have the ability to set a minimum number of employees you know will be active each month and you can choose which level of commitment fits best. We recommend setting your subscription to *Annual* to get an additional 50% off on your monthly Expensify bill. In the end, you've spent enough time getting your company fully set up with Expensify, and you've seen how well it supports you and your employees. Committing annually just makes sense.

To set your subscription, head to:

@@ -280,5 +280,5 @@ Now that we’ve gone through all of the steps for setting up your account, let

3. Enter your name, card number, postal code, expiration and CVV

4. Click *Accept Terms*

-## You’re all set!

+# You’re all set!

Congrats, you are all set up! If you need any assistance with anything mentioned above or would like to understand other features available in Expensify, reach out to your Setup Specialist directly in *[new.expensify.com](https://new.expensify.com)*. Don’t have one yet? Create a Control Policy, and we’ll automatically assign a dedicated Setup Specialist to you.

diff --git a/docs/articles/expensify-classic/exports/Custom-Templates.md b/docs/articles/expensify-classic/insights-and-custom-reporting/Custom-Templates.md

similarity index 100%

rename from docs/articles/expensify-classic/exports/Custom-Templates.md

rename to docs/articles/expensify-classic/insights-and-custom-reporting/Custom-Templates.md

diff --git a/docs/articles/expensify-classic/exports/Default-Export-Templates.md b/docs/articles/expensify-classic/insights-and-custom-reporting/Default-Export-Templates.md

similarity index 100%

rename from docs/articles/expensify-classic/exports/Default-Export-Templates.md

rename to docs/articles/expensify-classic/insights-and-custom-reporting/Default-Export-Templates.md

diff --git a/docs/articles/expensify-classic/exports/Insights.md b/docs/articles/expensify-classic/insights-and-custom-reporting/Insights.md

similarity index 100%

rename from docs/articles/expensify-classic/exports/Insights.md

rename to docs/articles/expensify-classic/insights-and-custom-reporting/Insights.md

diff --git a/docs/articles/expensify-classic/exports/Other-Export-Options.md b/docs/articles/expensify-classic/insights-and-custom-reporting/Other-Export-Options.md

similarity index 100%

rename from docs/articles/expensify-classic/exports/Other-Export-Options.md

rename to docs/articles/expensify-classic/insights-and-custom-reporting/Other-Export-Options.md

diff --git a/docs/articles/expensify-classic/integrations/accounting-integrations/Xero.md b/docs/articles/expensify-classic/integrations/accounting-integrations/Xero.md

index 3ee1c8656b4b..98cc6f2bfdf6 100644

--- a/docs/articles/expensify-classic/integrations/accounting-integrations/Xero.md

+++ b/docs/articles/expensify-classic/integrations/accounting-integrations/Xero.md

@@ -1,5 +1,260 @@

---

-title: Coming Soon

-description: Coming Soon

+title: The Xero Integration

+description: Everything you need to know about Expensify's direct integration with Xero

---

-## Resource Coming Soon!

+

+# About

+

+The integration enables seamless import of expense accounts into Expensify and sends expense reports back to Xero as purchasing bills awaiting payment or "spend money" bank transactions.

+

+# How-to Connect to Xero

+

+## Prerequisites

+

+You must be a Workspace Admin in Expensify using a Collect or Control Workspace to connect your Xero account to Expensify.

+

+## Connect Expensify and Xero

+

+1. Let's get started by heading over to your Settings. You can find it by following this path: *Settings > Workspaces > Groups > [Workspace Name] > Connections > Xero.*

+2. To connect Expensify to Xero, click on the "Connect to Xero” button, then choose "Create a new Xero connection."

+3. Next, enter your Xero login details. After that, you'll need to select the Xero organization you want to link with Expensify. Remember, you can connect one organization for each Workspace.

+

+One important note: Starting in September 2021, there's a chance for Cashbook and Ledger-type organizations in Xero. Apps like Expensify won't be able to create invoices and bills for these accounts using the Xero API. So, if you're using a Cashbook or Ledger Xero account, please be aware that this might affect your Expensify integration.

+

+# How to Configure Export Settings for Xero

+

+When you integrate Expensify with Xero you gain control over several settings that determine how your reports will be displayed in Xero. To manage these settings simply follow this path: *Settings > Workspaces > Group > [Workspace Name] > Connections > Accounting Integrations > Xero > Configure > Export*. This is where you can fine-tune how your reports appear on the Xero side, making your expense management a breeze!

+

+## Xero Organization

+

+When you have multiple organizations set up in Xero you can choose which one you'd like to connect. Here are some essential things to keep in mind:

+

+1. Organization Selection: You'll see this option only if you have multiple organizations configured in Xero.

+2. One Workspace, One Organization: Each Workspace can connect to just one organization at a time. It's a one-to-one connection.