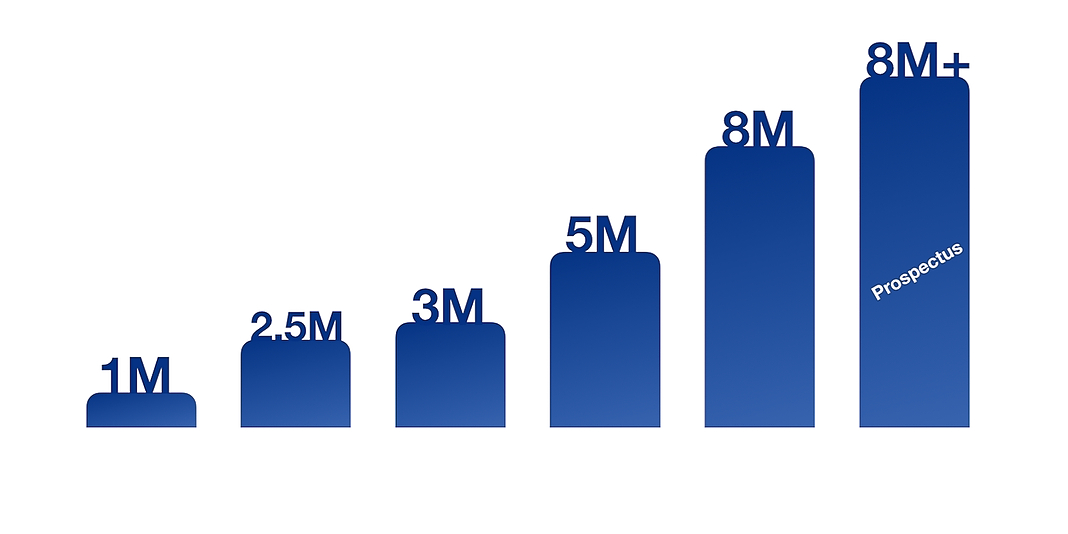

With regulators clamping down uncontrolled blockchain funding, I expect the number of ICOs to drop 90% from 980 registered in Q1 2018 to around 100–110 in Q4 2020. At the same time, regulatory compliance would allow STOs and IEOs to flourish.

With regulators clamping down uncontrolled blockchain funding, I expect the number of ICOs to drop 90% from 980 registered in Q1 2018 to around 100–110 in Q4 2020. At the same time, regulatory compliance would allow STOs and IEOs to flourish.

At the core of LCX’s infrastructure is their native LCX Token, aiming to elevate the platform to greater heights.

At the core of LCX’s infrastructure is their native LCX Token, aiming to elevate the platform to greater heights.

Issue No. 1

Issue No. 1

In the blockchain industry, there is now a lot of talk about replacing the ICO with a new, more legitimate method of attracting investment, called an STO. However, this definitely is not something completely new. During the heyday of the ICO, entering the market with security tokens was not very popular, and even now, many projects, and the investors themselves, do not always understand the difference. In this article, I will explain what makes an STO and an ICO fundamentally different.

In the blockchain industry, there is now a lot of talk about replacing the ICO with a new, more legitimate method of attracting investment, called an STO. However, this definitely is not something completely new. During the heyday of the ICO, entering the market with security tokens was not very popular, and even now, many projects, and the investors themselves, do not always understand the difference. In this article, I will explain what makes an STO and an ICO fundamentally different.

2017 will continue to evoke different memories for different individuals. As for the crypto space, it remains one of the critical moments in the history of cryptocurrency. To some, 2017 was the year that crypto millionaires came to the fore, while others still revel in the unprecedented publicity that spurred the numerous innovative movement that has come to define the space.

2017 will continue to evoke different memories for different individuals. As for the crypto space, it remains one of the critical moments in the history of cryptocurrency. To some, 2017 was the year that crypto millionaires came to the fore, while others still revel in the unprecedented publicity that spurred the numerous innovative movement that has come to define the space.

Asset tokenization is one of the latest blockchain trends to emerge in the fintech sector. This new concept offers a way of tokenizing just about anything, which helps inject liquidity into previously cumbersome assets.

Asset tokenization is one of the latest blockchain trends to emerge in the fintech sector. This new concept offers a way of tokenizing just about anything, which helps inject liquidity into previously cumbersome assets.

Let’s face it, you won’t be able to conduct a successful IEO unless you have a fully-operational and fully compliant prototype and unless you’ve clinched a listing deal with a major exchange with actual liquidity within its community of retail investors, and traders.

Let’s face it, you won’t be able to conduct a successful IEO unless you have a fully-operational and fully compliant prototype and unless you’ve clinched a listing deal with a major exchange with actual liquidity within its community of retail investors, and traders.

The concept of asset tokenization is still in its formative state, as companies are just coming to terms with the idea of capitalizing on blockchains to distribute shares and assets to interested investors. While this is a given, the concept is looking ever more likely to hit the ground running in 2020. This eventuality is bound to contribute to the potency of STOs as a fundraising mechanism for startups and established companies.

The concept of asset tokenization is still in its formative state, as companies are just coming to terms with the idea of capitalizing on blockchains to distribute shares and assets to interested investors. While this is a given, the concept is looking ever more likely to hit the ground running in 2020. This eventuality is bound to contribute to the potency of STOs as a fundraising mechanism for startups and established companies.

In project management, there are several key success criteria for the possible implementation of any project: from building a plant, developing a software product, opening a new supermarket to something else. They are time, budget and quality.

In project management, there are several key success criteria for the possible implementation of any project: from building a plant, developing a software product, opening a new supermarket to something else. They are time, budget and quality.

Content of the Article:

Content of the Article:

While some endorse IEOs, Kick Ecosystem’s CEO Danilevski argues that they’re a dangerous scam enterprise which will soon be replaced by the much more secure STOs and honest utility token sales.

While some endorse IEOs, Kick Ecosystem’s CEO Danilevski argues that they’re a dangerous scam enterprise which will soon be replaced by the much more secure STOs and honest utility token sales.

Marvin Steinberg is a renowned German serial entrepreneur who, after dominating the German energy startup sector, has made an entry into blockchain technology, with a goal at mainstreaming STO. Today, Marvin Steinberg will be sharing his thoughts on blockchain technology, startups, and security tokens, and offering advice to entrepreneurs interested in venturing into security tokens and STOs.

Marvin Steinberg is a renowned German serial entrepreneur who, after dominating the German energy startup sector, has made an entry into blockchain technology, with a goal at mainstreaming STO. Today, Marvin Steinberg will be sharing his thoughts on blockchain technology, startups, and security tokens, and offering advice to entrepreneurs interested in venturing into security tokens and STOs.

The advent of blockchain technology gave life not only to a new profitable financial asset, but also a new business model of funding startups. An increasing number of new companies are trying to use cryptocurrency to finance their projects. Unlike an IPO, which is a traditional and widely accepted form of external financing, STO, IEO, and ICO allow companies to start fundraising at a much earlier stage of development and the latter two avoid strict regulatory control. Already today, as a result of ICO, more than 1000 cryptocurrencies appeared on the market, and their number continues to grow. The practice of ICO has become so widespread that, in the opinion of many experts, it began to resemble the events of the dotcom boom of the late 90s and could lead to the same destructive consequences.

The advent of blockchain technology gave life not only to a new profitable financial asset, but also a new business model of funding startups. An increasing number of new companies are trying to use cryptocurrency to finance their projects. Unlike an IPO, which is a traditional and widely accepted form of external financing, STO, IEO, and ICO allow companies to start fundraising at a much earlier stage of development and the latter two avoid strict regulatory control. Already today, as a result of ICO, more than 1000 cryptocurrencies appeared on the market, and their number continues to grow. The practice of ICO has become so widespread that, in the opinion of many experts, it began to resemble the events of the dotcom boom of the late 90s and could lead to the same destructive consequences.